Page 274 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 274

Unit 11: Profit and Loss Prior to Incorporation

10. Gross profit must be apportioned between prior to incorporation period and post- Notes

incorporation period in the Ratio of Turnover.

11. Directors’ fees are apportioned on time basis to pre-incorporation and post-incorporation

period.

12. Statutory meeting of a public limited company is held only once in the life of the company.

13. Statutory report must be signed and certified by at least two directors of the company.

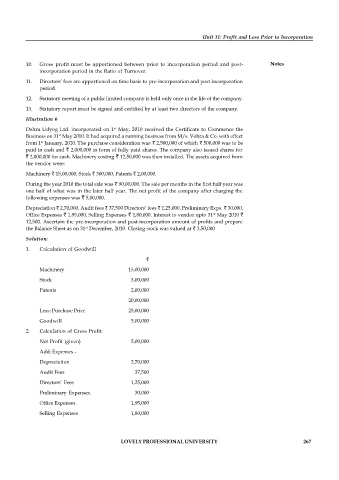

Illustration 6

st

Dehra Udyog Ltd. incorporated on 1 May, 2010 received the Certificate to Commence the

Business on 31 May 2010. It had acquired a running business from M/s. Vohra & Co. with effect

st

st

from 1 January, 2010. The purchase consideration was 2,500,000 of which 500,000 was to be

paid in cash and 2,000,000 in form of fully paid shares. The company also issued shares for

2,000,000 for cash. Machinery costing 12,50,000 was then installed. The assets acquired from

the vendor were:

Machinery 15,00,000, Stock 300,000, Patents 2,00,000.

During the year 2010 the total sale was 90,00,000. The sale per months in the first half year was

one half of what was in the later half year. The net profit of the company after charging the

following expenses was 5,00,000.

Depreciation 2,70,000. Audit fees 37,500 Directors’ fees 1,25,000, Preliminary Exps. 30,000,

Office Expenses 1,95,000, Selling Expenses 1,80,000. Interest to vendor upto 31 May 2010

st

12,500. Ascertain the pre-incorporation and post-incorporation amount of profits and prepare

the Balance Sheet as on 31 December, 2010. Closing stock was valued at 3,50,000

st

Solution:

1. Calculation of Goodwill

Machinery 15,00,000

Stock 3,00,000

Patents 2,00,000

20,00,000

Less: Purchase Price 25,00,000

Goodwill 5,00,000

2. Calculation of Gross Profit:

Net Profit (given) 5,00,000

Add: Expenses –

Depreciation 2,70,000

Audit Fees 37,500

Directors’ Fees 1,25,000

Preliminary Expenses. 30,000

Office Expenses 1,95,000

Selling Expenses 1,80,000

LOVELY PROFESSIONAL UNIVERSITY 267