Page 276 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 276

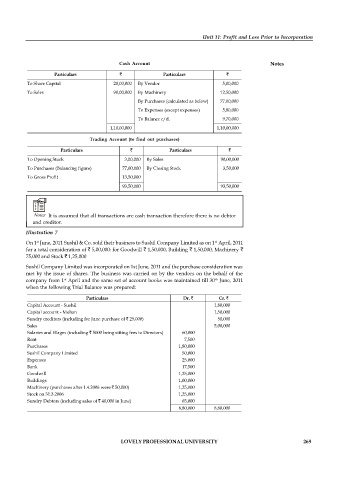

Unit 11: Profit and Loss Prior to Incorporation

Cash Account Notes

Particulars Particulars

To Share Capital 20,00,000 By Vendor 5,00,000

To Sales 90,00,000 By Machinery 12,50,000

By Purchases (calculated as below) 77,00,000

To Expenses (except expenses) 5,80,000

To Balance c/d. 9,70,000

1,10,00,000 1,10,00,000

Trading Account (to find out purchases)

Particulars Particulars

To Opening Stock 3,00,000 By Sales 90,00,000

To Purchases (Balancing figure) 77,00,000 By Closing Stock 3,50,000

To Gross Profit 13,50,000

93,50,000 93,50,000

Notes It is assumed that all transactions are cash transaction therefore there is no debtor

and creditor.

Illustration 7

st

On 1 June, 2011 Sushil & Co. sold their business to Sushil Company Limited as on 1 April, 2011

st

for a total consideration of 5,00,000: for Goodwill 1,50,000, Building 1,50,000, Machinery

75,000 and Stock 1,25,000

Sushil Company Limited was incorporated on 1st June, 2011 and the purchase consideration was

met by the issue of shares. The business was carried on by the vendors on the behalf of the

st

company from 1 April and the same set of account books was maintained till 30 June, 2011

th

when the following Trial Balance was prepared:

Particulars Dr. Cr.

Capital Account - Sushil 1,80,000

Capital account - Mohan 1,50,000

Sundry creditors (including for June purchase of 25,000) 50,000

Sales 5,00,000

Salaries and Wages (including 5000 being sitting fees to Directors) 60,000

Rent 7,500

Purchases 1,80,000

Sushil Company Limited 50,000

Expenses 25,000

Bank 17,500

Goodwill 1,25,000

Buildings 1,00,000

Machinery (purchases after 1.4.2006 were 50,000) 1,25,000

Stock on 31.3.2006 1,25,000

Sundry Debtors (including sales of 40,000 in June) 65,000

8,80,000 8,80,000

LOVELY PROFESSIONAL UNIVERSITY 269