Page 277 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 277

Accounting for Companies-I

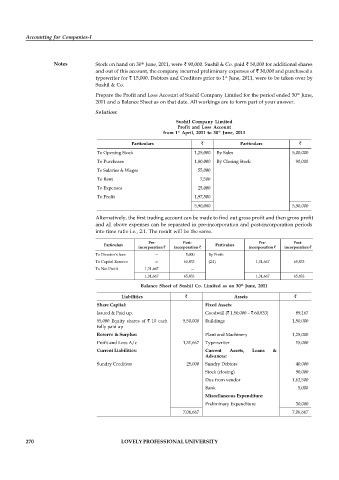

Notes Stock on hand on 30 June, 2011, were 90,000. Sushil & Co. paid 50,000 for additional shares

th

and out of this account, the company incurred preliminary expenses of 30,000 and purchased a

st

typewriter for 15,000. Debtors and Creditors prior to 1 June, 2011, were to be taken over by

Sushil & Co.

th

Prepare the Profit and Loss Account of Sushil Company Limited for the period ended 30 June,

2011 and a Balance Sheet as on that date. All workings are to form part of your answer.

Solution:

Sushil Company Limited

Profit and Loss Account

st

th

from 1 April, 2011 to 30 June, 2011

Particulars Particulars

To Opening Stock 1,25,000 By Sales 5,00,000

To Purchases 1,80,000 By Closing Stock 90,000

To Salaries & Wages 55,000

To Rent 7,500

To Expenses 25,000

To Profit 1,97,500

5,90,000 5,90,000

Alternatively, the first trading account can be made to find out gross profit and then gross profit

and all above expenses can be separated in pre-incorporation and post-incorporation periods

into time ratio i.e., 2:1. The result will be the same.

Pre- Post- Pre- Post-

Particulars Particulars

incorporation incorporation incorporation incorporation

To Director’s fees — 5,000 By Profit

To Capital Reserve — 60,833 (2:1) 1,31,667 65,833

To Net Profit 1,31,667 —

1,31,667 65,833 1,31,667 65,833

Balance Sheet of Sushil Co. Limited as on 30 June, 2011

th

Liabilities Assets

Share Capital: Fixed Assets:

Issued & Paid up. Goodwill ( 1,50,000 – 60,833) 89,167

55,000 Equity shares of 10 each 5,50,000 Buildings 1,50,000

fully paid up

Reserve & Surplus: Plant and Machinery 1,25,000

Profit and Loss A/c 1,31,667 Type-writer 15,000

Current Liabilities: Current Assets, Loans &

Advances:

Sundry Creditors 25,000 Sundry Debtors 40,000

Stock (closing) 90,000

Due from vendor 1,62,500

Bank 5,000

Miscellaneous Expenditure:

Preliminary Expenditure 30,000

7,06,667 7,06,667

270 LOVELY PROFESSIONAL UNIVERSITY