Page 273 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 273

Post-

Pre-

Post-

Particulars

Particulars

ration

incorporation

incorporation

ration

period

period

period

period

12,000

50,000

1,50,000

36,000

By Gross

To Salaries (1:3)

Profit b/d Pre-incorpo- incorpo-

(1:3)

To Miscellaneous

Exps. (1:3) 5,500 16,500 By Rent 3,250 9,750

Received

Accounting for Companies-I (1:3)

To Rates & Taxes (1:3) 1,750 5,250

To Repairs to 750 2,250

Buildings

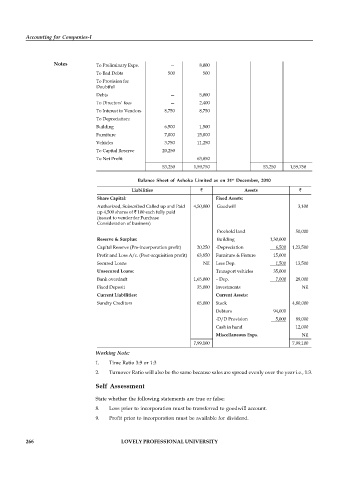

Notes To Preliminary Exps. — 8,000

To Bad Debts 500 500

To Provision for

Doubtful

Debts — 5,000

To Directors’ fees — 2,400

To Interest to Vendors 8,750 8,750

To Depreciation:

Building 6,500 1,500

Furniture 7,000 15,000

Vehicles 3,750 11,250

To Capital Reserve 20,250

To Net Profit 63,850

53,250 1,59,750 53,250 1,59,750

Balance Sheet of Ashoka Limited as on 31 December, 2010

st

Liabilities Assets

Share Capital: Fixed Assets:

Authorized, Subscribed Called up and Paid 4,50,000 Goodwill 3,100

up 4,500 shares of 100 each fully paid

(issued to vendor for Purchase

Consideration of business)

Freehold land 50,000

Reserve & Surplus: Building 1,30,000

Capital Reserve (Pre-incorporation profit) 20,250 -Depreciation 6,500 1,23,500

Profit and Loss A/c. (Post-acquisition profit) 63,850 Furniture & Fixture 15,000

Secured Loans Nil Less Dep. 1,500 13,500

Unsecured Loans: Transport vehicles 35,000

Bank overdraft 1,65,000 – Dep. 7,000 28,000

Fixed Deposit 35,000 Investments Nil

Current Liabilities: Current Assets:

Sundry Creditors 65,000 Stock 4,80,000

Debtors 94,000

-D/D Provision 5,000 89,000

Cash in hand 12,000

Miscellaneous Exps. Nil

7,99,100 7,99,100

Working Note:

1. Time Ratio 3:9 or 1:3

2. Turnover Ratio will also be the same because sales are spread evenly over the year i.e., 1:3.

Self Assessment

State whether the following statements are true or false:

8. Loss prior to incorporation must be transferred to goodwill account.

9. Profit prior to incorporation must be available for dividend.

266 LOVELY PROFESSIONAL UNIVERSITY