Page 278 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 278

Unit 11: Profit and Loss Prior to Incorporation

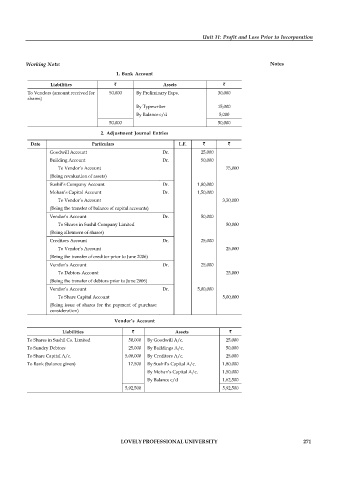

Working Note: Notes

1. Bank Account

Liabilities ` Assets `

To Vendors (amount received for 50,000 By Preliminary Exps. 30,000

shares)

By Typewriter 15,000

By Balance c/d 5,000

50,000 50,000

2. Adjustment Journal Entries

Date Particulars L.F. ` `

Goodwill Account Dr. 25,000

Building Account Dr. 50,000

To Vendor’s Account 75,000

(Being revaluation of assets)

Sushil’s Company Account Dr. 1,80,000

Mohan’s Capital Account Dr. 1,50,000

To Vendor’s Account 3,30,000

(Being the transfer of balance of capital accounts)

Vendor’s Account Dr. 50,000

To Shares in Sushil Company Limited 50,000

(Being allotment of shares)

Creditors Account Dr. 25,000

To Vendor’s Account 25,000

(Being the transfer of creditor prior to June 2006)

Vendor’s Account Dr. 25,000

To Debtors Account 25,000

(Being the transfer of debtors prior to June 2006)

Vendor’s Account Dr. 5,00,000

To Share Capital Account 5,00,000

(Being issue of shares for the payment of purchase

consideration)

Vendor’s Account

Liabilities ` Assets `

To Shares in Sushil Co. Limited 50,000 By Goodwill A/c. 25,000

To Sundry Debtors 25,000 By Buildings A/c. 50,000

To Share Capital A/c. 5,00,000 By Creditors A/c. 25,000

To Bank (balance given) 17,500 By Sushil’s Capital A/c. 1,80,000

By Mohan’s Capital A/c. 1,50,000

By Balance c/d 1,62,500

5,92,500 5,92,500

LOVELY PROFESSIONAL UNIVERSITY 271