Page 293 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 293

Accounting for Companies-I

Notes (a) Children’s education allowance: In case of children studying in or outside India, an

allowance limited to a maximum of 5,000 per month per child or actual expenses

incurred whichever is less. Such allowance is admissible upto a maximum of two

children.

(b) Holiday passage of children studying outside India or family studying abroad: return holiday

passage once in a year by economy class or once in two years by first class to

children and to the members of the family from the place of their study or stay

outside India, if they are not residing in India with the managerial person.

(c) Leave travel concession: Return passage for self and family in accordance with the

rules specified by the company where it is proposed that the leave be spent in home

country instead; anywhere in India.

Explanation: For the purpose of this part, family means the spouse, dependent children

and dependent parents of the managerial person.

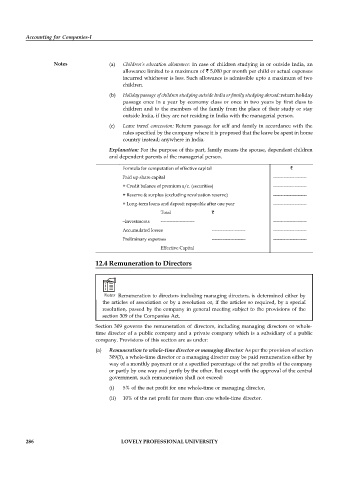

Formula for computation of effective capital

Paid up share capital ----------------------

+ Credit balance of premium a/c. (securities) ----------------------

+ Reserve & surplus (excluding revaluation reserve) ----------------------

+ Long-term loans and deposit repayable after one year ----------------------

Total

–Investments ---------------------- ----------------------

Accumulated losses ---------------------- ----------------------

Preliminary expenses ---------------------- ----------------------

Effective Capital

12.4 Remuneration to Directors

Notes Remuneration to directors including managing directors, is determined either by

the articles of association or by a resolution or, if the articles so required, by a special

resolution, passed by the company in general meeting subject to the provisions of the

section 309 of the Companies Act.

Section 309 governs the remuneration of directors, including managing directors or whole-

time director of a public company and a private company which is a subsidiary of a public

company. Provisions of this section are as under:

(a) Remuneration to whole-time director or managing director: As per the provision of section

309(3), a whole-time director or a managing director may be paid remuneration either by

way of a monthly payment or at a specified percentage of the net profits of the company

or partly by one way and partly by the other. But except with the approval of the central

government, such remuneration shall not exceed:

(i) 5% of the net profit for one whole-time or managing director,

(ii) 10% of the net profit for more than one whole-time director.

286 LOVELY PROFESSIONAL UNIVERSITY