Page 296 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 296

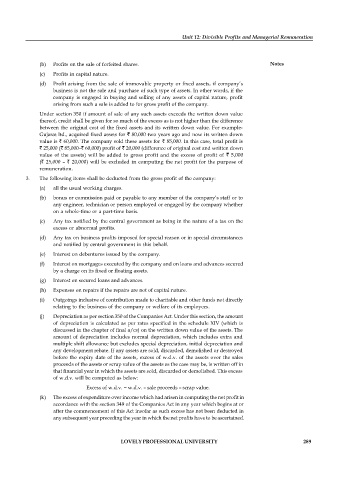

Unit 12: Divisible Profits and Managerial Remuneration

(b) Profits on the sale of forfeited shares. Notes

(c) Profits in capital nature.

(d) Profit arising from the sale of immovable property or fixed assets, if company’s

business is not the sale and purchase of such type of assets. In other words, if the

company is engaged in buying and selling of any assets of capital nature, profit

arising from such a sale is added to for gross profit of the company.

Under section 350 if amount of sale of any such assets exceeds the written down value

thereof, credit shall be given for so much of the excess as is not higher than the difference

between the original cost of the fixed assets and its written down value. For example-

Gujarat ltd., acquired fixed assets for ` 80,000 two years ago and now its written down

value is ` 60,000. The company sold these assets for ` 85,000. In this case, total profit is

` 25,000 (` 85,000–` 60,000) profit of ` 20,000 (difference of original cost and written down

value of the assets) will be added to gross profit and the excess of profit of ` 5,000

(` 25,000 – ` 20,000) will be excluded in computing the net profit for the purpose of

remuneration.

3. The following items shall be deducted from the gross profit of the company:

(a) all the usual working charges.

(b) bonus or commission paid or payable to any member of the company’s staff or to

any engineer, technician or person employed or engaged by the company whether

on a whole-time or a part-time basis.

(c) Any tax notified by the central government as being in the nature of a tax on the

excess or abnormal profits.

(d) Any tax on business profits imposed for special reason or in special circumstances

and notified by central government in this behalf.

(e) Interest on debentures issued by the company.

(f) Interest on mortgages executed by the company and on loans and advances secured

by a charge on its fixed or floating assets.

(g) Interest on secured loans and advances.

(h) Expenses on repairs if the repairs are not of capital nature.

(i) Outgoings inclusive of contribution made to charitable and other funds not directly

relating to the business of the company or welfare of its employees.

(j) Depreciation as per section 350 of the Companies Act. Under this section, the amount

of depreciation is calculated as per rates specified in the schedule XIV (which is

discussed in the chapter of final a/cs) on the written down value of the assets. The

amount of depreciation includes normal depreciation, which includes extra and

multiple shift allowance but excludes special depreciation, initial depreciation and

any development rebate. If any assets are sold, discarded, demolished or destroyed

before the expiry date of the assets, excess of w.d.v. of the assets over the sales

proceeds of the assets or scrap value of the assets as the case may be, is written off in

that financial year in which the assets are sold, discarded or demolished. This excess

of w.d.v. will be computed as below:

Excess of w.d.v. = w.d.v. – sale proceeds – scrap value.

(k) The excess of expenditure over income which had arisen in computing the net profit in

accordance with the section 349 of the Companies Act in any year which begins at or

after the commencement of this Act insofar as such excess has not been deducted in

any subsequent year preceding the year in which the net profits have to be ascertained.

LOVELY PROFESSIONAL UNIVERSITY 289