Page 301 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 301

Accounting for Companies-I

Notes (viii) Scientific research expenditure (for setting up new machinery) 70,000

(ix) Managing director’s remuneration paid 1,05,000

Other information:

(i) Depreciation allowable under schedule XIV of the Companies Act 1,22,500

(ii) Bonus liability as per payment of bonus act 63,000

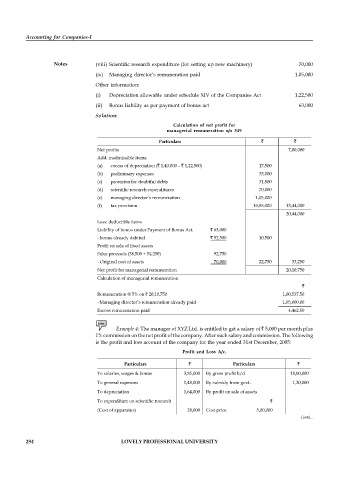

Solution:

Calculation of net profit for

managerial remuneration u/s 349

Particulars

Net profits 7,00,000

Add: inadmissible items:

(a) excess of depreciation ( 1,40,000 – 1,22,500) 17,500

(b) preliminary expenses 35,000

(c) provision for doubtful debts 31,500

(d) scientific research expenditures 70,000

(e) managing director’s remuneration 1,05,000

(f) tax provision 10,85,000 13,44,000

20,44,000

Less: deductible items

Liability of bonus under Payment of Bonus Act. 63,000

- bonus already debited 52,500 10,500

Profit on sale of fixed assets

Sales proceeds (38,500 + 54,250) 92,750

- Original cost of assets 70,000 22,750 33,250

Net profit for managerial remuneration 20,10,750

Calculation of managerial remuneration

Remuneration @ 5% on 20,10,750 1,00,537.50

–Managing director’s remuneration already paid 1,05,000.00

Excess remuneration paid 4,462.50

Example 4: The manager of XYZ Ltd. is entitled to get a salary of 5,000 per month plus

1% commission on the net profit of the company. After such salary and commission. The following

is the profit and loss account of the company for the year ended 31st December, 2005:

Profit and Loss A/c.

Particulars Particulars

To salaries, wages & bonus 3,85,000 By gross profit b/d 18,00,000

To general expenses 1,48,000 By subsidy from govt. 1,20,000

To depreciation 1,64,000 By profit on sale of assets

To expenditure on scientific research

(Cost of apparatus) 28,000 Cost price 5,00,000

Contd...

To manager’s salary 60,000 W.D.V. 3,60,000 2,00,000

To commission to manager 12,000

To provision for bad & doubtful 35,000

294 LOVELY PROFESSIONAL UNIVERSITY

debts

To provision for income tax 4,80,000

To proposed divided 2,00,000

To balance c/d 6,08,000

21,20,000 21,20,000