Page 306 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 306

Unit 12: Divisible Profits and Managerial Remuneration

Remuneration to part-time directors 10,811 Notes

Total managerial remuneration 1,29,730

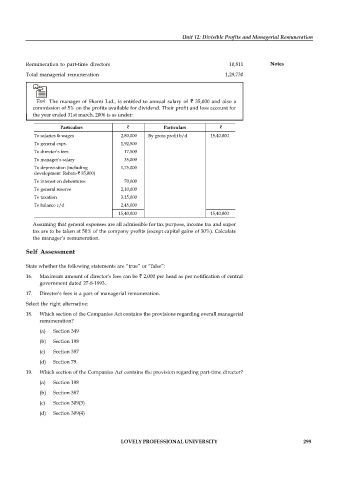

Task The manager of Shanti Ltd., is entitled to annual salary of 35,000 and also a

commission of 5% on the profits available for dividend. Their profit and loss account for

the year ended 31st march, 2006 is as under:

Particulars Particulars

To salaries & wages 2,80,000 By gross profit b/d 15,40,000

To general exps. 1,92,500

To director’s fees 17,500

To manager’s salary 35,000

To depreciation (including 1,75,000

development Rebate 35,000)

To interest on debentures 70,000

To general reserve 2,10,000

To taxation 3,15,000

To balance c/d 2,45,000

15,40,000 15,40,000

Assuming that general expenses are all admissible for tax purpose, income tax and super

tax are to be taken at 50% of the company profits (except capital gains of 30%). Calculate

the manager’s remuneration.

Self Assessment

State whether the following statements are “true” or “false”:

16. Maximum amount of director's fees can be 2,000 per head as per notification of central

government dated 27-8-1993.

17. Director's fees is a part of managerial remuneration.

Select the right alternative:

18. Which section of the Companies Act contains the provisions regarding overall managerial

remuneration?

(a) Section 349

(b) Section 198

(c) Section 387

(d) Section 79.

19. Which section of the Companies Act contains the provision regarding part-time director?

(a) Section 198

(b) Section 387

(c) Section 309(3)

(d) Section 309(4)

LOVELY PROFESSIONAL UNIVERSITY 299