Page 304 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 304

Unit 12: Divisible Profits and Managerial Remuneration

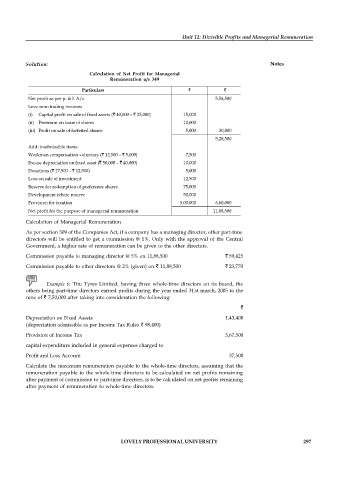

Solution: Notes

Calculation of Net Profit for Managerial

Remuneration u/s 349

Particulars

Net profit as per p. & l. A/c. 5,58,500

Less: non–trading incomes

(i) Capital profit on sale of fixed assets ( 40,000 – 25,000) 15,000

(ii) Premium on issue of shares 10,000

(iii) Profit on sale of forfeited shares 5,000 30,000

5,28,500

Add: inadmissible items:

Workmen compensation voluntary ( 12,500 – 5,000) 7,500

Excess depreciation on fixed asset ( 50,000 – 40,000) 10,000

Donations ( 17,500 – 12,500) 5,000

Loss on sale of investment 12,500

Reserve for redemption of preference shares 75,000

Development rebate reserve 50,000

Provision for taxation 5,00,000 6,60,000

Net profit for the purpose of managerial remuneration 11,88,500

Calculation of Managerial Remuneration

As per section 309 of the Companies Act, if a company has a managing director, other part-time

directors will be entitled to get a commission @ 1%. Only with the approval of the Central

Government, a higher rate of remuneration can be given to the other directors.

Commission payable to managing director @ 5% on 11,88,500 59,425

Commission payable to other directors @ 2% (given) on 11,88,500 23,770

Example 6: Titu Tyres Limited, having three whole-time directors on its board, the

others being part-time directors earned profits during the year ended 31st march, 2005 to the

tune of 7,50,000 after taking into consideration the following:

Depreciation on Fixed Assets 1,43,400

(depreciation admissible as per Income Tax Rules 98,400)

Provision of Income Tax 3,67,500

capital expenditure included in general expenses charged to

Profit and Loss Account 37,500

Calculate the maximum remuneration payable to the whole-time directors, assuming that the

remuneration payable to the whole-time directors to be calculated on net profits remaining

after payment of commission to part-time directors, is to be calculated on net profits remaining

after payment of remuneration to whole-time directors.

LOVELY PROFESSIONAL UNIVERSITY 297