Page 300 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 300

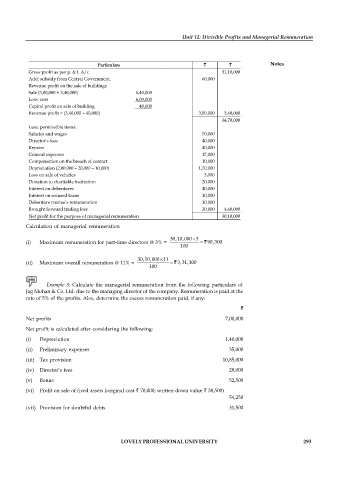

Unit 12: Divisible Profits and Managerial Remuneration

Particulars Notes

Gross profit as per p. & l. A/c 31,10,000

Add: subsidy from Central Government. 60,000

Revenue profit on the sale of buildings

Sale (3,00,000 + 3,40,000) 6,40,000

Less: cost 6,00,000

Capital profit on sale of building 40,000

Revenue profit = (3,40,000 – 40,000) 3,00,000 3,60,000

34,70,000

Less: permissible items:

Salaries and wages 70,000

Director’s fees 40,000

Repairs 40,000

General expenses 17,000

Compensation on the breach of contact 10,000

Depreciation (2,00,000 – 20,000 – 10,000) 1,70,000

Loss on sale of vehicles 3,000

Donation to charitable institution 20,000

Interest on debentures 40,000

Interest on secured loans 10,000

Debenture trustee’s remuneration 10,000

Brought forward trading loss 30,000 4,60,000

Net profit for the purpose of managerial remuneration 30,10,000

Calculation of managerial remuneration

30,10,000 3

(i) Maximum remuneration for part-time directors @ 3% = 90,300

100

30,10,000 11

(ii) Maximum overall remuneration @ 11% = 3,31,100

100

Example 3: Calculate the managerial remuneration from the following particulars of

Jag Mohan & Co. Ltd. due to the managing director of the company. Remuneration is paid at the

rate of 5% of the profits. Also, determine the excess remuneration paid, if any:

Net profits 7,00,000

Net profit is calculated after considering the following:

(i) Depreciation 1,40,000

(ii) Preliminary expenses 35,000

(iii) Tax provision 10,85,000

(iv) Director’s fees 28,000

(v) Bonus 52,500

(vi) Profit on sale of fixed assets (original cost 70,000; written down value 38,500)

54,250

(vii) Provision for doubtful debts 31,500

LOVELY PROFESSIONAL UNIVERSITY 293