Page 298 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 298

Unit 12: Divisible Profits and Managerial Remuneration

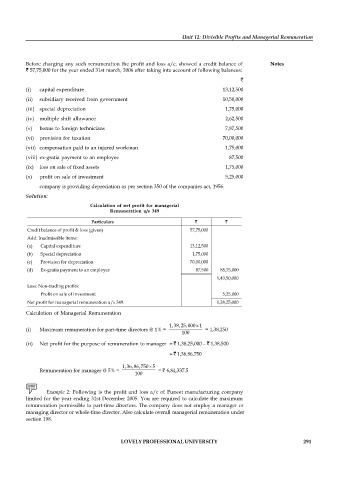

Before charging any such remuneration the profit and loss a/c, showed a credit balance of Notes

57,75,000 for the year ended 31st march, 2006 after taking into account of following balances:

(i) capital expenditure 13,12,500

(ii) subsidiary received from government 10,50,000

(iii) special depreciation 1,75,000

(iv) multiple shift allowance 2,62,500

(v) bonus to foreign technicians 7,87,500

(vi) provision for taxation 70,00,000

(vii) compensation paid to an injured workman 1,75,000

(viii) ex-gratia payment to an employee 87,500

(ix) loss on sale of fixed assets 1,75,000

(x) profit on sale of investment 5,25,000

company is providing depreciation as per section 350 of the companies act, 1956.

Solution:

Calculation of net profit for managerial

Remuneration u/s 349

Particulars

Credit balance of profit & loss (given) 57,75,000

Add: Inadmissible items:

(a) Capital expenditure 13,12,500

(b) Special depreciation 1,75,000

(c) Provision for depreciation 70,00,000

(d) Ex-gratia payment to an employee 87,500 85,75,000

1,43,50,000

Less: Non-trading profits:

Profit on sale of investment 5,25,000

Net profit for managerial remuneration u/s 349. 1,38,25,000

Calculation of Managerial Remuneration

1,38,25,000 1

(i) Maximum remuneration for part-time directors @ 1% = = 1,38,250

100

(ii) Net profit for the purpose of remuneration to manager = 1,38,25,000 – 1,38,500

= 1,36,86,750

1,36,86,750 5

Remuneration for manager @ 5% = = 6,84,337.5

100

Example 2: Following is the profit and loss a/c of Puneet manufacturing company

limited for the year ending 31st December 2005. You are required to calculate the maximum

remuneration permissible to part-time directors. The company does not employ a manager or

managing director or whole-time director. Also calculate overall managerial remuneration under

section 198.

LOVELY PROFESSIONAL UNIVERSITY 291