Page 295 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 295

Accounting for Companies-I

Notes Remuneration to Manager

Provisions regarding remuneration to manager are given in the section 387 of the Companies Act

1956. According to this section, a company can pay the remuneration to a manager by the way of

a monthly payment or by way of a specific percentage of the net profits of the company or partly

by way of monthly payment and partly by way of specific percentage of the net profits. The net

profit of the company is calculated according to sections 349 and 350 of the Companies Act.

!

Caution The total remuneration to the manager cannot exceed 5% of the net profit of the

company, except with the approval of the Central Government.

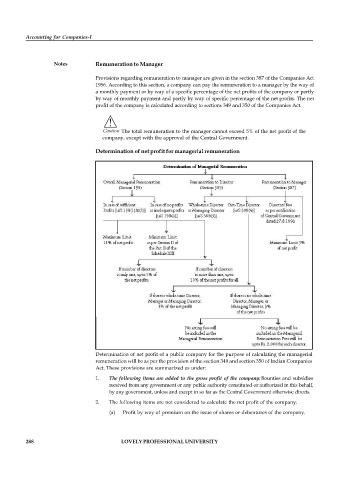

Determination of net profit for managerial remuneration

Determination of net profit of a public company for the purpose of calculating the managerial

remuneration will be as per the provision of the section 349 and section 350 of Indian Companies

Act. These provisions are summarized as under:

1. The following items are added to the gross profit of the company: Bounties and subsidies

received from any government or any public authority constituted or authorized in this behalf,

by any government, unless and except in so far as the Central Government otherwise directs.

2. The following items are not considered to calculate the net profit of the company:

(a) Profit by way of premium on the issue of shares or debentures of the company.

288 LOVELY PROFESSIONAL UNIVERSITY