Page 302 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 302

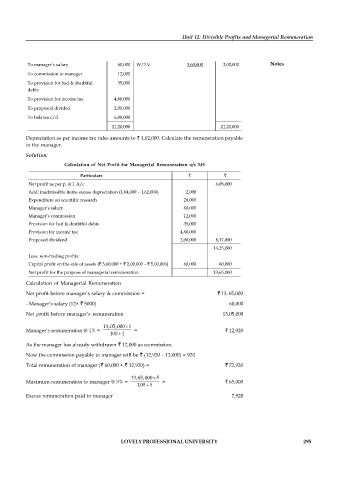

Particulars Particulars

To salaries, wages & bonus 3,85,000 By gross profit b/d 18,00,000

To general expenses 1,48,000 By subsidy from govt. 1,20,000

Unit 12: Divisible Profits and Managerial Remuneration

To depreciation 1,64,000 By profit on sale of assets

To expenditure on scientific research

(Cost of apparatus) 28,000 Cost price 5,00,000

To manager’s salary 60,000 W.D.V. 3,60,000 2,00,000 Notes

To commission to manager 12,000

To provision for bad & doubtful 35,000

debts

To provision for income tax 4,80,000

To proposed divided 2,00,000

To balance c/d 6,08,000

21,20,000 21,20,000

Depreciation as per income tax rules amounts to 1,62,000. Calculate the remuneration payable

to the manager.

Solution:

Calculation of Net Profit for Managerial Remuneration u/s 349

Particulars

Net profit as per p. & l. A/c 6,08,000

Add: inadmissible items excess depreciation (1,64,000 – 1,62,000) 2,000

Expenditure on scientific research 28,000

Manager’s salary 60,000

Manager’s commission 12,000

Provision for bad & doubtful debts 35,000

Provision for income tax 4,80,000

Proposed dividend 2,00,000 8,17,000

14,25,000

Less: non-trading profits:

Capital profit on the sale of assets ( 3,60,000 + 2,00,000 – 5,00,000) 60,000 60,000

Net profit for the purpose of managerial remuneration 13,65,000

Calculation of Managerial Remuneration

Net profit before manager’s salary & commission = 13, 65,000

- Manager’s salary (12× 5000) 60,000

Net profit before manager’s remuneration 13,05,000

13,05,000 1

Manager’s remuneration @ 1% = = 12,920

100 1

As the manager has already withdrawn 12,000 as commission,

Now the commission payable to manager will be (12,920 – 12,000) = 920

Total remuneration of manager ( 60,000 + 12,920) = 72,920

13,65,000 5

Maximum remuneration to manager @ 5% = = 65,000

100 5

Excess remuneration paid to manager 7,920

LOVELY PROFESSIONAL UNIVERSITY 295