Page 349 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 349

5. Current Liabilities &

Provisions

(1) Claims against the

company not

A. Current Liabilities

acknowledged as

(1) Acceptance

debts.

(2) Sundry Creditors

(2) Uncalled liabilities

(3) Advances payments

on shares partly paid

& unexpired

up

discounts for the

portion for which

(3) Arrears of fixed

value has still to be

cumulative

given

dividends.

(4) Unclaimed Dividend

(4) Estimated amount of

(5) Other liabilities but

contracts remaining

not due on Loans

to be executed on

(6) Interest Accrued 5. Profit and Loss A/c.

capital account and

B. Provisions not provided for

(1) Provisions for (5) Other money for

taxation which company is

Accounting for Companies-I (2) Proposed Dividends, contingently liable.

(3) For Contingencies

(4) For Provident Fund

scheme

Notes (5) Fire Insurance,

Pension and similar

staff benefits scheme

(6) Other Provisions

[A footnote to the

balance sheet may be

added to show

separately]

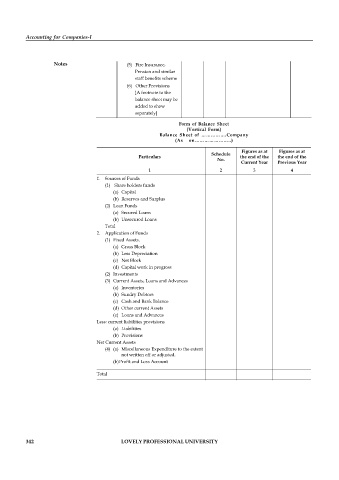

Form of Balance Sheet

(Vertical Form)

Balance Sheet of …………….Company

(As on…………………..)

Figures as at Figures as at

Schedule

Particulars the end of the the end of the

No.

Current Year Previous Year

1 2 3 4

1. Sources of Funds

(1) Share holders funds

(a) Capital

(b) Reserves and Surplus

(2) Loan Funds

(a) Secured Loans

(b) Unsecured Loans

Total

2. Application of Funds

(1) Fixed Assets.

(a) Gross Block

(b) Less Depreciation

(c) Net Block

(d) Capital work in progress

(2) Investments

(3) Current Assets, Loans and Advances

(a) Inventories

(b) Sundry Debtors

(c) Cash and Bank Balance

(d) Other current Assets

(e) Loans and Advances

Less: current liabilities provisions

(a) Liabilities

(b) Provisions

Net Current Assets

(4) (a) Miscellaneous Expenditure to the extent

not written off or adjusted.

(b) Profit and Loss Account

Total

342 LOVELY PROFESSIONAL UNIVERSITY