Page 353 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 353

Accounting for Companies-I

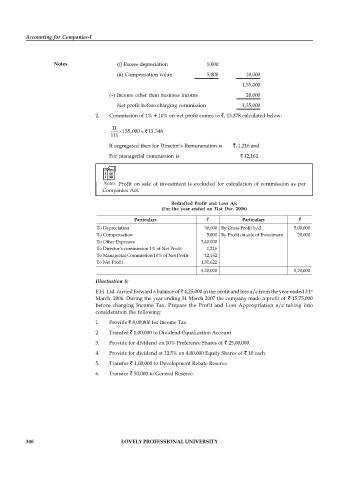

Notes (i) Excess depreciation 5,000

(ii) Compensation value 5,000 10,000

1,55,000

(–) Income other than business income 20,000

Net profit before charging commission 1,35,000

2. Commission of 1% + 10% on net profit comes to , 13,378 calculated below:

11

135,000 13,348

111

If segregated then for Director’s Remuneration is , 1,216 and

For managerial commission is 12,162.

Notes Profit on sale of investment is excluded for calculation of commission as per

Companies Act.

Redrafted Profit and Loss A/c

(For the year ended on 31st Dec. 2006)

Particulars Particulars

To Depreciation 30,000 By Gross Profit b/d 5,00,000

To Compensation 5,000 By Profit on sale of Investment 20,000

To Other Expenses 3,40,000

To Director’s commission 1% of Net Profit 1,216

To Managerial Commission 10% of Net Profit 12,162

To Net Profit 1,31,622

5,20,000 5,20,000

Illustration 6:

E.H. Ltd. carried forward a balance of 4,25,000 in the profit and loss a/c from the year ended 31 st

March, 2006. During the year ending 31 March 2007 the company made a profit of 15,75,000

before charging Income Tax. Prepare the Profit and Loss Appropriation a/c taking into

consideration the following:

1. Provide 8,00,000 for Income Tax.

2. Transfer 1,00,000 to Dividend Equalization Account

3. Provide for dividend on 10% Preference Shares of 25,00,000.

4. Provide for dividend at 12.5% on 4,00,000 Equity Shares of 10 each.

5. Transfer 1,00,000 to Development Rebate Reserve.

6. Transfer 50,000 to General Reserve.

346 LOVELY PROFESSIONAL UNIVERSITY