Page 355 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 355

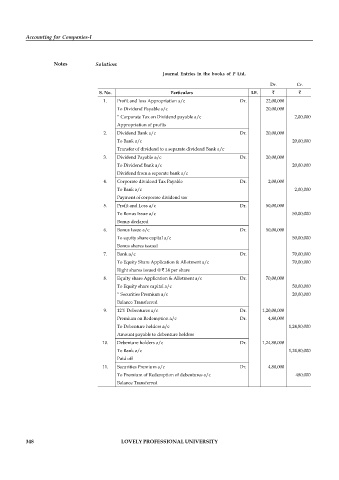

Accounting for Companies-I

Notes Solution:

Journal Entries in the books of P Ltd.

Dr. Cr.

S. No. Particulars LF.

1. Profit and loss Appropriation a/c Dr. 22,00,000

To Dividend Payable a/c 20,00,000

“ Corporate Tax on Dividend payable a/c 2,00,000

Appropriation of profits

2. Dividend Bank a/c Dr. 20,00,000

To Bank a/c 20,00,000

Transfer of dividend to a separate dividend Bank a/c

3. Dividend Payable a/c Dr. 20,00,000

To Dividend Bank a/c 20,00.000

Dividend from a separate bank a/c

4. Corporate dividend Tax Payable Dr. 2,00,000

To Bank a/c 2,00,000

Payment of corporate dividend tax

5. Profit and Loss a/c Dr. 50,00,000

To Bonus Issue a/c 50,00,000

Bonus declared

6. Bonus Issue a/c Dr. 50,00,000

To equity share capital a/c 50,00,000

Bonus shares issued

7. Bank a/c Dr. 70,00,000

To Equity Share Application & Allotment a/c 70,00,000

Right shares issued @ 14 per share

8. Equity share Application & Allotment a/c Dr. 70,00,000

To Equity share capital a/c 50,00,000

“ Securities Premium a/c 20,00,000

Balance Transferred

9. 12% Debentures a/c Dr. 1,20,00,000

Premium on Redemption a/c Dr. 4,80,000

To Debenture holders a/c 1,24,80,000

Amount payable to debenture holders

10. Debenture holders a/c Dr. 1,24,80,000

To Bank a/c 1,24,80,000

Paid off

11. Securities Premium a/c Dr. 4,80,000

To Premium of Redemption of debentures a/c 480,000

Balance Transferred

348 LOVELY PROFESSIONAL UNIVERSITY