Page 358 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 358

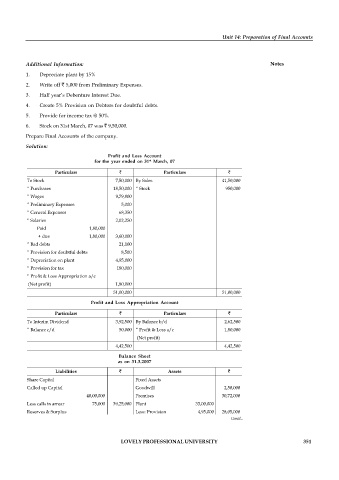

Unit 14: Preparation of Final Accounts

Additional Information: Notes

1. Depreciate plant by 15%

2. Write off 5,000 from Preliminary Expenses.

3. Half year’s Debenture Interest Due.

4. Create 5% Provision on Debtors for doubtful debts.

5. Provide for income tax @ 50%.

6. Stock on 31st March, 07 was 9,50,000.

Prepare Final Accounts of the company.

Solution:

Profit and Loss Account

for the year ended on 31 March, 07

st

Particulars Particulars

To Stock 7,50,000 By Sales 41,50,000

“ Purchases 18,50,000 “ Stock 950,000

“ Wages 9,79,800

“ Preliminary Expenses 5,000

“ General Expenses 68,350

“ Salaries 2,02,250

Paid 1,80,000

+ due 1,80,000 3,60,000

“ Bad debts 21,100

“ Provision for doubtful debts 8,500

“ Depreciation on plant 4,95,000

“ Provision for tax 180,000

“ Profit & Loss Appropriation a/c

(Net profit) 1,80,000

51,00,000 51,00,000

Profit and Loss Appropriation Account

Particulars Particulars

To Interim Dividend 3,92,500 By Balance b/d 2,62,500

“ Balance c/d 50,000 “ Profit & Loss a/c 1,80,000

(Net profit)

4,42,500 4,42,500

Balance Sheet

as on 31.3.2007

Liabilities Assets

Share Capital Fixed Assets

Called up Capital Goodwill 2,50,000

40,00,000 Premises 30,72,000

Less calls in arrear 75,000 39,25,000 Plant 33,00,000

Reserves & Surplus Less: Provision 4,95,000 28,05,000

General Reserve 2,50,000 Current Assets, Loans and Advances Contd...

Profit & Loss a/c 50,000

Secured Loans Current Assets:

LOVELY PROFESSIONAL UNIVERSITY 351

12% Debentures 30,00,000 Stock 9,50,000

O/s Interest 1,80,000 31,80,000 Debtors 8,70,000

Current liabilities and Provisions Provision 43,500 8,26,500

Cash & Bank 4,06,500

Current Liabilities Miscellaneous Expenditure:

Creditors 4,00,000 Preliminary Expenses 45,000

Bills Payable 3,70,000

Provision

Provision for tax 1,80,000

83,55,000 83,55,000