Page 356 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 356

Unit 14: Preparation of Final Accounts

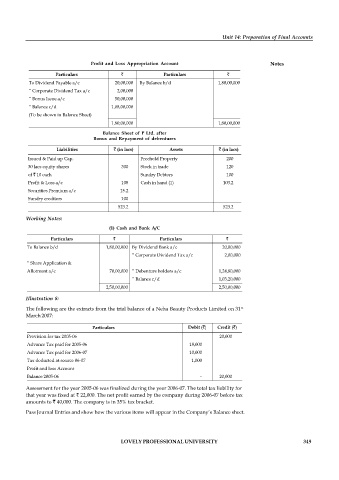

Profit and Loss Appropriation Account Notes

Particulars Particulars

To Dividend Payable a/c 20,00,000 By Balance b/d 1,80,00,000

“ Corporate Dividend Tax a/c 2,00,000

“ Bonus Issue a/c 50,00,000

“ Balance c/d 1,08,00,000

(To be shown in Balance Sheet)

1,80,00,000 1,80,00,000

Balance Sheet of P Ltd. after

Bonus and Repayment of debentures

Liabilities (in lacs) Assets (in lacs)

Issued & Paid up Cap. Freehold Property 200

30 lacs equity shares 300 Stock in trade 120

of 10 each Sundry Debtors 100

Profit & Loss a/c 108 Cash in hand (1) 103.2

Securities Premium a/c 15.2

Sundry creditors 100

523.2 523.2

Working Notes:

(1) Cash and Bank A/C

Particulars Particulars

To Balance b/d 1,80,00,000 By Dividend Bank a/c 20,00,000

” Corporate Dividend Tax a/c 2,00,000

“ Share Application &

Allotment a/c 70,00,000 ” Debenture holders a/c 1,24,80,000

” Balance c/d 1,03,20,000

2,50,00,000 2,50,00,000

Illustration 8:

The following are the extracts from the trial balance of a Neha Beauty Products Limited on 31 st

March 2007:

Particulars Debit ( ) Credit ( )

Provision for tax 2005-06 20,000

Advance Tax paid for 2005-06 18,000

Advance Tax paid for 2006-07 10,000

Tax deducted at source 06-07 1,000

Profit and loss Account

Balance 2005-06 – 20,000

Assessment for the year 2005-06 was finalized during the year 2006-07. The total tax liability for

that year was fixed at 22,000. The net profit earned by the company during 2006-07 before tax

amounts to 40,000. The company is in 35% tax bracket.

Pass Journal Entries and show how the various items will appear in the Company’s Balance sheet.

LOVELY PROFESSIONAL UNIVERSITY 349