Page 352 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 352

Unit 14: Preparation of Final Accounts

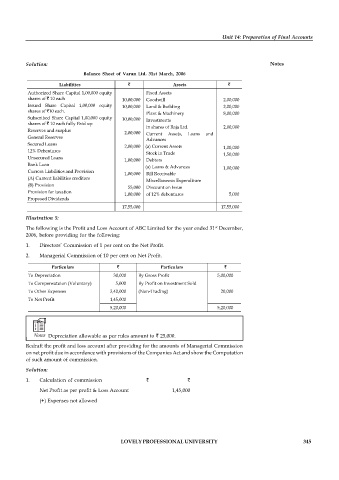

Solution: Notes

Balance Sheet of Varun Ltd. 31st March, 2006

Liabilities ` Assets `

Authorized Share Capital 1,00,000 equity Fixed Assets

shares of ` 10 each 10,00,000 Goodwill 2,00,000

Issued Share Capital 1,00,000 equity 10,00,000 Land & Building 2,00,000

shares of `10 each.

Plant & Machinery 8,00,000

Subscribed Share Capital 1,00,000 equity 10,00,000 Investments

shares of ` 10 each fully Paid up

in shares of Raja Ltd. 2,00,000

Reserves and surplus

2,00,000 Current Assets, Loans and

General Reserves

Advances

Secured Loans

2,00,000 (a) Current Assets 1,00,000

12% Debentures

Stock in Trade 1,50,000

Unsecured Loans

1,00,000 Debtors

Bank Loan

(a) Loans & Advances 1,00,000

Current Liabilities and Provision

1,00,000 Bill Receivable

(A) Current liabilities creditors

Miscellaneous Expenditure

(B) Provision

55,000 Discount on Issue

Provision for taxation

1,00,000 of 12% debentures 5,000

Proposed Dividends

17,55,000 17,55,000

Illustration 5:

st

The following is the Profit and Loss Account of ABC Limited for the year ended 31 December,

2006, before providing for the following:

1. Directors’ Commission of 1 per cent on the Net Profit.

2. Managerial Commission of 10 per cent on Net Profit.

Particulars ` Particulars `

To Depreciation 30,000 By Gross Profit 5,00,000

To Compensatuion (Voluntary) 5,000 By Profit on Investment Sold

To Other Expenses 3,40,000 (Non-Trading) 20,000

To Net Profit 1,45,000

5,20,000 5,20,000

Notes Depreciation allowable as per rules amount to ` 25,000.

Redraft the profit and loss account after providing for the amounts of Managerial Commission

on net profit due in accordance with provisions of the Companies Act and show the Computation

of such amount of commission.

Solution:

1. Calculation of commission ` `

Net Profit as per profit & Loss Account 1,45,000

(+) Expenses not allowed

LOVELY PROFESSIONAL UNIVERSITY 345