Page 357 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 357

Accounting for Companies-I

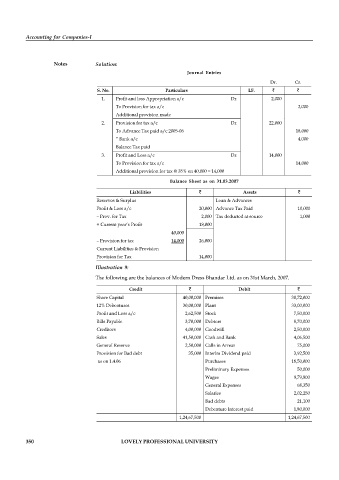

Notes Solution:

Journal Entries

Dr. Cr.

S. No. Particulars LF.

1. Profit and loss Appropriation a/c Dr. 2,000

To Provision for tax a/c 2,000

Additional provision made

2. Provision for tax a/c Dr. 22,000

To Advance Tax paid a/c 2005-06 18,000

“ Bank a/c 4,000

Balance Tax paid

3. Profit and Loss a/c Dr. 14,000

To Provision for tax a/c 14,000

Additional provision for tax @ 35% on 40,000 = 14,000

Balance Sheet as on 31.03.2007

Liabilities Assets

Reserves & Surplus Loan & Advances

Profit & Loss a/c 20,000 Advance Tax Paid 10,000

– Prov. for Tax 2,000 Tax deducted at source 1,000

+ Current year’s Profit 18,000

40,000

– Provision for tax 14,000 26,000

Current Liabilities & Provision

Provision for Tax 14,000

Illustration 9:

The following are the balances of Modern Dress Bhandar Ltd. as on 31st March, 2007.

Credit Debit

Share Capital 40,00,000 Premises 30,72,000

12% Debentures 30,00,000 Plant 33,00,000

Profit and Loss a/c 2,62,500 Stock 7,50,000

Bills Payable 3,70,000 Debtors 8,70,000

Creditors 4,00,000 Goodwill 2,50,000

Sales 41,50,000 Cash and Bank 4,06,500

General Reserve 2,50,000 Calls in Arrear 75,000

Provision for Bad debt 35,000 Interim Dividend paid 3,92,500

as on 1.4.06 Purchases 18,50,000

Preliminary Expenses 50,000

Wages 9,79,800

General Expenses 68,350

Salaries 2,02,250

Bad debts 21,100

Debenture Interest paid 1,80,000

1,24,67,500 1,24,67,500

350 LOVELY PROFESSIONAL UNIVERSITY