Page 360 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 360

Unit 14: Preparation of Final Accounts

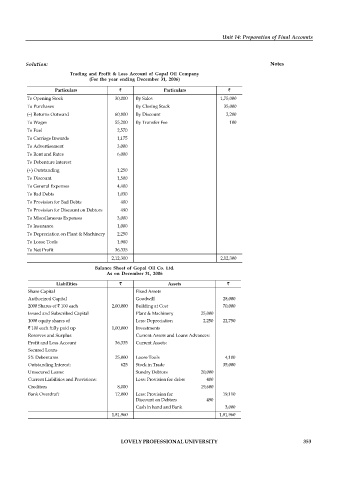

Solution: Notes

Trading and Profit & Loss Account of Gopal Oil Company

(For the year ending December 31, 2006)

Particulars Particulars

To Opening Stock 30,000 By Sales 1,75,000

To Purchases 60,900 By Closing Stock 35,000

(–) Returns Outward 100 60,800 By Discount 2,200

To Wages 55,200 By Transfer Fee 100

To Fuel 2,570

To Carriage Inwards 1,175

To Advertisement 3,000

To Rent and Rates 6,000

To Debenture Interest 625

(+) Outstanding 625 250

1,

To Discount 1,500

To General Expenses 4,400

To Bad Debts 1,030

To Provision for Bad Debts 400

To Provision for Discount on Debtors 490

To Miscellaneous Expenses 3,000

To Insurance 1,000

To Depreciation on Plant & Machinery 2,250

To Loose Tools 1,900

To Net Profit 36,335

2,12,300 2,12,300

Balance Sheet of Gopal Oil Co. Ltd.

As on December 31, 2006

Liabilities Assets

Share Capital Fixed Assets

Authorized Capital Goodwill 28,000

2000 Shares of 100 each 2,00,000 Building at Cost 70,000

Issued and Subscribed Capital Plant & Machinery 25,000

1000 equity shares of Less: Depreciation 2,250 22,750

100 each fully paid up 1,00,000 Investments

Reserves and Surplus: Current Assets and Loans Advances:

Profit and Loss Account 36,335 Current Assets:

Secured Loans

5% Debentures 25,000 Loose Tools 4,100

Outstanding Interest: 625 Stock in Trade 35,000

Unsecured Loans: Sundry Debtors 20,000

Current Liabilities and Provisions: Less: Provision for debts 400

Creditors 8,000 19,600

Bank Overdraft 12,000 Less: Provision for 19,110

Discount on Debtors 490

Cash in hand and Bank 3,000

1,81,960 1,81,960

LOVELY PROFESSIONAL UNIVERSITY 353