Page 78 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 78

Unit 3: Reissue of Forfeited Shares and Bonus Issue

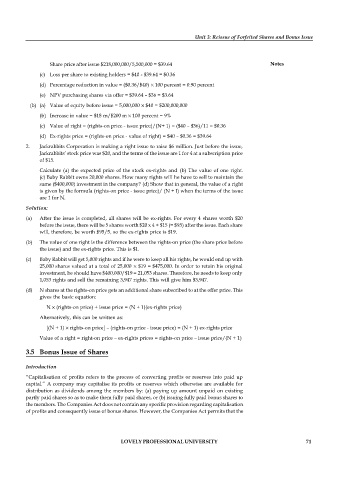

Share price after issue $218,000,000/5,500,000 = $39.64 Notes

(c) Loss per share to existing holders = $40 - $39.64 = $0.36

(d) Percentage reduction in value = ($0.36/$40) 100 percent = 0.90 percent

(e) NPV purchasing shares via offer = $39.64 – $36 = $3.64

(b) (a) Value of equity before issue = 5,000,000 $40 = $200,000,000

(b) Increase in value = $18 m/$200 m 100 percent = 9%

(c) Value of right = (rights-on price - issue price)/(N+ 1) = ($40 – $36)/11 = $0.36

(d) Ex-rights price = (rights-on price - value of right) = $40 – $0.36 = $39.64

2. Jackrabbits Corporation is making a right issue to raise $6 million. Just before the issue,

Jackrabbits’ stock price was $20, and the terms of the issue are 1 for 4 at a subscription price

of $15.

Calculate (a) the expected price of the stock ex-rights and (b) The value of one right.

(c) Baby Rabbit owns 20,000 shares. How many rights will he have to sell to maintain the

same ($400,000) investment in the company? (d) Show that in general, the value of a right

is given by the formula (rights-on price - issue price)/ (N + I) when the terms of the issue

are 1 for N.

Solution:

(a) After the issue is completed, all shares will be ex-rights. For every 4 shares worth $20

before the issue, there will be 5 shares worth $20 x 4 + $15 (= $95) after the issue. Each share

will, therefore, be worth $95/5, so the ex-rights price is $19.

(b) The value of one right is the difference between the rights-on price (the share price before

the issue) and the ex-rights price. This is $1.

(c) Baby Rabbit will get 5,000 rights and if he were to keep all his rights, he would end up with

25,000 shares valued at a total of 25,000 $19 = $475,000. In order to retain his original

investment, he should have $400,000/$19 = 21,053 shares. Therefore, he needs to keep only

1,053 rights and sell the remaining 3,947 rights. This will give him $3,947.

(d) N shares at the rights-on price gets an additional share subscribed to at the offer price. This

gives the basic equation:

N (rights-on price) + issue price = (N + 1)(ex-rights price)

Alternatively, this can be written as:

[(N + 1) rights-on price] – (rights-on price - issue price) = (N + 1) ex-rights price

Value of a right = right-on price – ex-rights prices = rights-on price – issue price/(N + 1)

3.5 Bonus Issue of Shares

Introduction

“Capitalisation of profits refers to the process of converting profits or reserves into paid up

capital.” A company may capitalise its profits or reserves which otherwise are available for

distribution as dividends among the members by: (a) paying up amount unpaid on existing

partly paid shares so as to make them fully paid shares, or (b) issuing fully paid bonus shares to

the members. The Companies Act does not contain any specific provision regarding capitalisation

of profits and consequently issue of bonus shares. However, the Companies Act permits that the

LOVELY PROFESSIONAL UNIVERSITY 71