Page 84 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 84

`

Assets

Liabilities

`

Share Capital:

Fixed Assets:

Authorised

Issued and Subscribed: 60,00,000 Land and Buildings 25,00,000

20,00,000

Plant and Machinery

4,80,000 equity shares of ` 10 each fully Furniture and Fittings 11,70,000

paid up (of the above 60,000 equity 48,00,000

shares are issues as fully paid up bonus

shares)

Unit 3: Reissue of Forfeited Shares and Bonus Issue

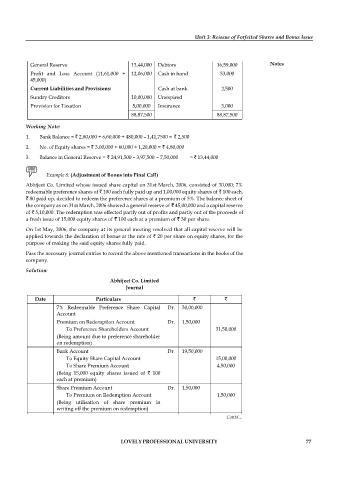

Reserve & Surplus: Current Assets:

Loans and Advances:

Capital Reserve 37,500 Stock 15,00,000

General Reserve 13,44,000 Debtors 16,59,000 Notes

Profit and Loss Account (11,61,000 + 12,06,000 Cash in hand 53,000

45,000)

Current Liabilities and Provisions: Cash at bank 2,500

Sundry Creditors 10,00,000 Unexpired

Provision for Taxation 5,00,000 Insurance 3,000

88,87,500 88,87,500

Working Note:

1. Bank Balance = ` 2,80,000 + 6,60,000 + 480,000 – 1,41,7500 = ` 2,500

2. No. of Equity shares = ` 3,00,000 + 60,000 + 1,20,000 = ` 4,80,000

3. Balance in General Reserve = ` 24,91,500 – 3,97,500 – 7,50,000 = ` 13,44,000

Example 8: (Adjustment of Bonus into Final Call)

Abhijeet Co. Limited whose issued share capital on 31st March, 2006, consisted of 30,000; 7%

redeemable preference shares of ` 100 each fully paid up and 1,00,000 equity shares of ` 100 each,

` 80 paid up, decided to redeem the preference shares at a premium of 5%. The balance sheet of

the company as on 31st March, 2006 showed a general reserve of ` 45,00,000 and a capital reserve

of ` 5,10,000. The redemption was effected partly out of profits and partly out of the proceeds of

a fresh issue of 15,000 equity shares of ` 100 each at a premium of ` 30 per share.

On 1st May, 2006, the company at its general meeting resolved that all capital reserve will be

applied towards the declaration of bonus at the rate of ` 20 per share on equity shares, for the

purpose of making the said equity shares fully paid.

Pass the necessary journal entries to record the above mentioned transactions in the books of the

company.

Solution:

Abhijeet Co. Limited

Journal

Date Particulars ` `

7% Redeemable Preference Share Capital Dr. 30,00,000

Account

Premium on Redemption Account Dr. 1,50,000

To Preference Shareholders Account 31,50,000

(Being amount due to preference shareholder

on redemption)

Bank Account Dr. 19,50,000

To Equity Share Capital Account 15,00,000

To Share Premium Account 4,50,000

(Being 15,000 equity shares issued of ` 100

each at premium)

Share Premium Account Dr. 1,50,000

To Premium on Redemption Account 1,50,000

(Being utilisation of share premium in

writing off the premium on redemption)

General Reserve Account Dr. 15,00,000 Contd...

To Capital Redemption Reserve Account 15,00,000

(Being utilisation of general reserve for

redemption of capital)

LOVELY PROFESSIONAL UNIVERSITY 77

Preference Shareholders Account Dr. 31,50,000

To Bank Account 31,50,000

(Being payment made to preference

shareholders on redemption)

Equity Shares Find Call Account Dr. 20,00,000

To Equity Share Capital Account 20,00,000

(Being final call of ` 20 each due on 1,00,000

equity shares)

Capital Reserve Account Dr. 5,10,000

Capital Redemption Reserve Account Dr. 14,90,000

To Bonus to Shareholders Account 20,00,000

(Being bonus declared to make fully paid up

shares)

Bonus to Share-holders Account Dr. 20,00,000

To Equity Shares Final Call Account 20,00,000

(Being adjustment of bonus in final call of

equity shares)