Page 85 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 85

Particulars

Date

Dr.

Account

Premium on Redemption Account

1,50,000

Dr.

To Preference Shareholders Account

(Being amount due to preference shareholder

on redemption)

Bank Account

19,50,000

Dr.

7% Redeemable Preference Share Capital L.F. 30,00,000 31,50,000

To Equity Share Capital Account

15,00,000

To Share Premium Account 4,50,000

(Being 15,000 equity shares issued of 100

each at premium)

Share Premium Account Dr. 1,50,000

Accounting for Companies-I

To Premium on Redemption Account 1,50,000

(Being utilisation of share premium in

writing off the premium on redemption)

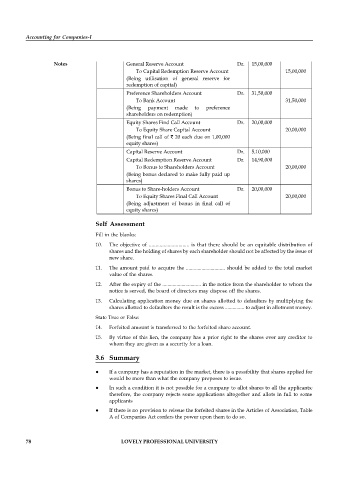

Notes General Reserve Account Dr. 15,00,000

To Capital Redemption Reserve Account 15,00,000

(Being utilisation of general reserve for

redemption of capital)

Preference Shareholders Account Dr. 31,50,000

To Bank Account 31,50,000

(Being payment made to preference

shareholders on redemption)

Equity Shares Find Call Account Dr. 20,00,000

To Equity Share Capital Account 20,00,000

(Being final call of 20 each due on 1,00,000

equity shares)

Capital Reserve Account Dr. 5,10,000

Capital Redemption Reserve Account Dr. 14,90,000

To Bonus to Shareholders Account 20,00,000

(Being bonus declared to make fully paid up

shares)

Bonus to Share-holders Account Dr. 20,00,000

To Equity Shares Final Call Account 20,00,000

(Being adjustment of bonus in final call of

equity shares)

Self Assessment

Fill in the blanks:

10. The objective of .............................. is that there should be an equitable distribution of

shares and the holding of shares by each shareholder should not be affected by the issue of

new share.

11. The amount paid to acquire the .............................. should be added to the total market

value of the shares.

12. After the expiry of the .............................. in the notice from the shareholder to whom the

notice is served, the board of directors may dispose off the shares.

13. Calculating application money due on shares allotted to defaulters by multiplying the

shares allotted to defaulters the result is the excess ............... to adjust in allotment money.

State True or False:

14. Forfeited amount is transferred to the forfeited share account.

15. By virtue of this lien, the company has a prior right to the shares over any creditor to

whom they are given as a security for a loan.

3.6 Summary

If a company has a reputation in the market, there is a possibility that shares applied for

would be more than what the company proposes to issue.

In such a condition it is not possible for a company to allot shares to all the applicants;

therefore, the company rejects some applications altogether and allots in full to some

applicants

If there is no provision to reissue the forfeited shares in the Articles of Association, Table

A of Companies Act confers the power upon them to do so.

78 LOVELY PROFESSIONAL UNIVERSITY