Page 172 - DCOM202_COST_ACCOUNTING_I

P. 172

Cost Accounting – I

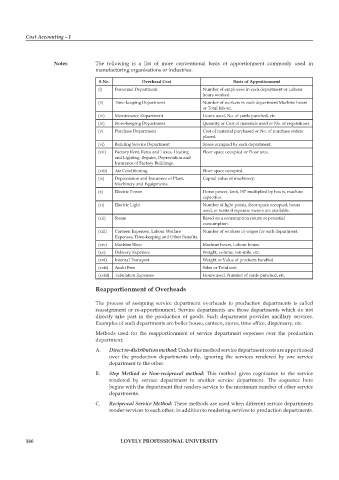

Notes The following is a list of more conventional basis of apportionment commonly used in

manufacturing organisations or industries:

S.No. Overhead Cost Basis of Apportionment

(i) personnel Department Number of employees in each department or Labour

hours worked.

(ii) Time-keeping Department Number of workers in each department Machine hours

or Total labour.

(iii) Maintenance Department Hours used, No. of cards punched, etc.

(iv) Store-keeping Department Quantity or Cost of materials used or No. of requisitions.

(v) purchase Department Cost of material purchased or No. of purchase orders

placed.

(vi) Building Service Department Space occupied by each department.

(vii) Factory Rent, Rates and Taxes, Heating Floor space occupied or Floor area.

and Lighting, Repairs, Depreciation and

Insurance of Factory Buildings.

(viii) Air Conditioning Floor space occupied.

(ix) Depreciation and Insurance of plant, Capital value of machinery.

Machinery and Equipments.

(x) Electric power Horse power, kwh, HP multiplied by hours, machine

capacities.

(xi) Electric Light Number of light points, floor space occupied, hours

used, or watts if separate meters are available.

(xii) Steam Based on a consumption return or potential

consumption.

(xiii) Canteen Expenses, Labour Welfare Number of workers or wages for each department.

Expenses, Time-keeping and Other Benefits.

(xiv) Machine Shop Machine hours, Labour hours.

(xv) Delivery Expenses Weight, volume, ton-mile, etc.

(xvi) Internal Transport Weight or Value of products handled.

(xvii) Audit Fees Sales or Total cost.

(xviii) Tabulation Expenses Hours used, Number of cards punched, etc.

Reapportionment of Overheads

The process of assigning service department overheads to production departments is called

reassignment or re-apportionment. Service departments are those departments which do not

directly take part in the production of goods. Such department provides ancillary services.

Examples of such departments are boiler house, canteen, stores, time office, dispensary, etc.

Methods used for the reapportionment of service department expenses over the production

department:

A. Direct re-distribution method: Under this method service department costs are apportioned

over the production departments only, ignoring the services rendered by one service

department to the other.

B. Step Method or Non-reciprocal method: This method gives cognizance to the service

rendered by service department to another service department. The sequence here

begins with the department that renders service to the maximum number of other service

departments.

C. Reciprocal Service Method: These methods are used when different service departments

render services to each other, in addition to rendering services to production departments.

166 LOVELY PROFESSIONAL UNIVERSITY