Page 175 - DCOM202_COST_ACCOUNTING_I

P. 175

Unit 8: Overheads

Supervision 15,000 Notes

Fire insurance 5,000

power 9,000

Employer’s liability insurance 1,500

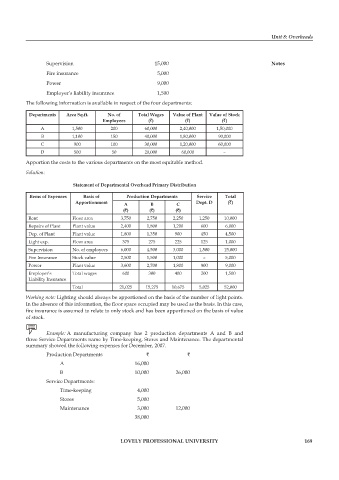

The following information is available in respect of the four departments:

departments Area Sq.ft. No. of Total Wages Value of Plant Value of Stock

Employees (`) (`) (`)

A 1,500 200 60,000 2,40,000 1,50,000

B 1,100 150 40,000 1,80,000 90,000

C 900 100 30,000 1,20,000 60,000

D 500 50 20,000 60,000 –

Apportion the costs to the various departments on the most equitable method.

Solution:

Statement of departmental Overhead Primary distribution

Items of Expenses Basis of Production departments Service Total

Apportionment A B C dept. d (`)

(`) (`) (`)

Rent Floor area 3,750 2,750 2,250 1,250 10,000

Repairs of plant plant value 2,400 1,800 1,200 600 6,000

Dep. of plant plant value 1,800 1,350 900 450 4,500

Light exp. Floor area 375 275 225 125 1,000

Supervision No. of employees 6,000 4,500 3,000 1,500 15,000

Fire Insurance Stock value 2,500 1,500 1,000 – 5,000

power plant value 3,600 2,700 1,800 900 9,000

Employer’s Total wages 600 300 400 200 1,500

Liability Insurance

Total 21,025 15,275 10,675 5,025 52,000

Working note: Lighting should always be apportioned on the basis of the number of light points.

In the absence of this information, the floor space occupied may be used as the basis. In this case,

fire insurance is assumed to relate to only stock and has been apportioned on the basis of value

of stock.

Example: A manufacturing company has 2 production departments A and B and

three Service Departments name by Time-keeping, Stores and Maintenance. The departmental

summary showed the following expenses for December, 2007.

production Departments ` `

A 16,000

B 10,000 26,000

Service Departments:

Time-keeping 4,000

Stores 5,000

Maintenance 3,000 12,000

38,000

LOVELY PROFESSIONAL UNIVERSITY 169