Page 178 - DCOM202_COST_ACCOUNTING_I

P. 178

Cost Accounting – I

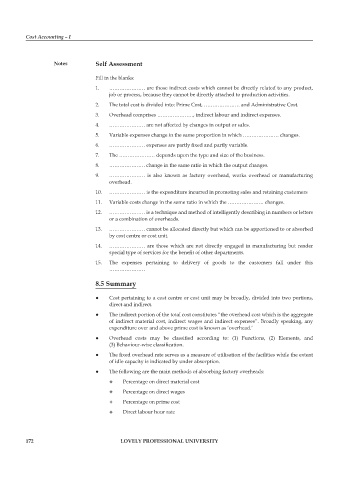

Notes Self Assessment

Fill in the blanks:

1. ………………… are those indirect costs which cannot be directly related to any product,

job or process, because they cannot be directly attached to production activities.

2. The total cost is divided into: prime Cost, ………………… and Administrative Cost.

3. Overhead comprises …………………, indirect labour and indirect expenses.

4. ………………… are not affected by changes in output or sales.

5. Variable expenses change in the same proportion in which ………………… changes.

6. ………………… expenses are partly fixed and partly variable.

7. The ………………… depends upon the type and size of the business.

8. ………………… change in the same ratio in which the output changes.

9. ………………… is also known as factory overhead, works overhead or manufacturing

overhead.

10. ………………… is the expenditure incurred in promoting sales and retaining customers

11. Variable costs change in the same ratio in which the ………………… changes.

12. ………………… is a technique and method of intelligently describing in numbers or letters

or a combination of overheads.

13. ………………… cannot be allocated directly but which can be apportioned to or absorbed

by cost centre or cost unit.

14. ………………… are those which are not directly engaged in manufacturing but render

special type of services for the benefit of other departments.

15. The expenses pertaining to delivery of goods to the customers fall under this

…………………

8.5 Summary

z z Cost pertaining to a cost centre or cost unit may be broadly, divided into two portions,

direct and indirect.

z z The indirect portion of the total cost constitutes “the overhead cost which is the aggregate

of indirect material cost, indirect wages and indirect expenses”. Broadly speaking, any

expenditure over and above prime cost is known as ‘overhead.’

z z Overhead costs may be classified according to: (1) Functions, (2) Elements, and

(3) Behaviour-wise classification.

z z The fixed overhead rate serves as a measure of utilisation of the facilities while the extent

of idle capacity is indicated by under absorption.

z z The following are the main methods of absorbing factory overheads:

z percentage on direct material cost

z percentage on direct wages

z percentage on prime cost

z Direct labour hour rate

172 LOVELY PROFESSIONAL UNIVERSITY