Page 177 - DCOM202_COST_ACCOUNTING_I

P. 177

Unit 8: Overheads

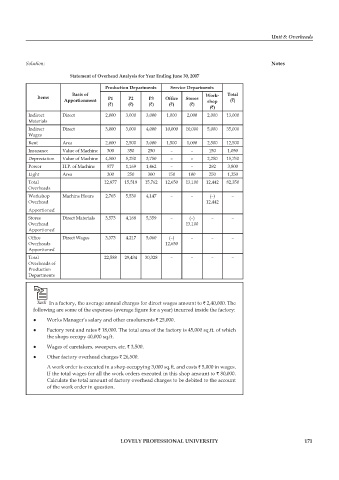

Solution: Notes

Statement of Overhead Analysis for Year Ending June 30, 2007

Production departments Service departments

Basis of Work- Total

Items P1 P2 P3 Office Stores

Apportionment shop (`)

(`) (`) (`) (`) (`)

(`)

Indirect Direct 2,000 3,000 3,000 1,000 2,000 2,000 13,000

Materials

Indirect Direct 3,000 3,000 4,000 10,000 10,000 5,000 35,000

Wages

Rent Area 2,000 2,500 3,000 1,500 1,000 2,500 12,500

Insurance Value of Machine 300 350 250 – – 150 1,050

Depreciation Value of Machine 4,500 5,250 3,750 – – 2,250 15,750

power H.p. of Machine 877 1,169 1,462 – – 292 3,800

Light Area 200 250 300 150 100 250 1,250

Total 12,877 15,519 15,762 12,650 13,100 12,442 82,350

Overheads

Workshop Machine Hours 2,765 5,530 4,147 – – (–) –

Overhead 12,442

Apportioned

Stores Direct Materials 3,573 4,168 5,359 – (–) – –

Overhead 13,100

Apportioned

Office Direct Wages 3,373 4,217 5,060 (–) – – –

Overheads 12,650

Apportioned

Total 22,588 29,434 30,328 – – – –

Overheads of

production

Departments

Task In a factory, the average annual charges for direct wages amount to ` 2,40,000. The

following are some of the expenses (average figure for a year) incurred inside the factory:

z z Works Manager’s salary and other emoluments ` 25,000.

z z Factory rent and rates ` 18,000. The total area of the factory is 45,000 sq.ft. of which

the shops occupy 40,000 sq.ft.

z z Wages of caretakers, sweepers, etc. ` 3,500.

z z Other factory overhead charges ` 26,500.

A work order is executed in a shop occupying 3,000 sq.ft. and costs ` 5,000 in wages.

If the total wages for all the work orders executed in this shop amount to ` 80,000.

Calculate the total amount of factory overhead charges to be debited to the account

of the work order in question.

LOVELY PROFESSIONAL UNIVERSITY 171