Page 188 - DCOM202_COST_ACCOUNTING_I

P. 188

Cost Accounting – I

Notes

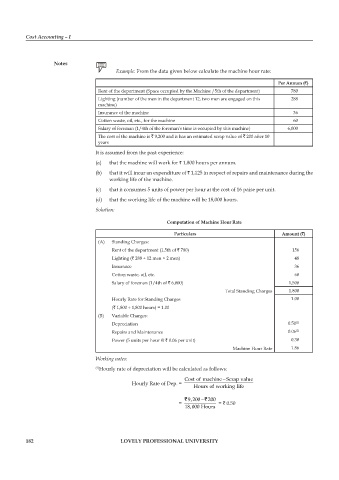

Example: From the data given below calculate the machine hour rate:

Per Annum (`)

Rent of the department (Space occupied by the Machine /5th of the department) 780

Lighting (number of the men in the department 12, two men are engaged on this 288

machine)

Insurance of the machine 36

Cotton waste, oil, etc., for the machine 60

Salary of foreman (1/4th of the foreman’s time is occupied by this machine) 6,000

The cost of the machine is ` 9,200 and it has an estimated scrap value of ` 200 after 10

years

It is assumed from the past experience:

(a) that the machine will work for ` 1,800 hours per annum.

(b) that it will incur an expenditure of ` 1,125 in respect of repairs and maintenance during the

working life of the machine.

(c) that it consumes 5 units of power per hour at the cost of 16 paise per unit.

(d) that the working life of the machine will be 18,000 hours.

Solution:

Computation of Machine Hour Rate

Particulars Amount (`)

(A) Standing Charges:

Rent of the department (1.5th of ` 780) 156

Lighting (` 288 ÷ 12 men × 2 men) 48

Insurance 36

Cotton waste, oil, etc. 60

Salary of foreman (1/4th of ` 6,000) 1,500

Total Standing Charges 1,800

Hourly Rate for Standing Charges 1.00

(` 1,800 ÷ 1,800 hours) = 1.00

(B) Variable Charges:

Depreciation 0.50 (1)

(2)

Repairs and Maintenance 0.06

power (5 units per hour @ ` 0.06 per unit) 0.30

Machine Hour Rate 1.86

Working notes:

(1) Hourly rate of depreciation will be calculated as follows:

−

Cost of machineScrap value

Hourly Rate of Dep. =

Hoursofworking life

`9 200 − ` 200

,

= = ` 0.50

,

18 000 Hours

182 LOVELY PROFESSIONAL UNIVERSITY