Page 185 - DCOM202_COST_ACCOUNTING_I

P. 185

Unit 9: Absorption of Overheads

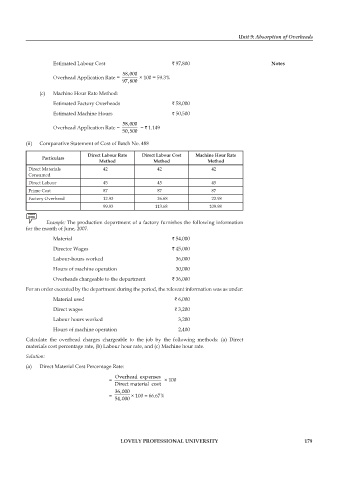

Estimated Labour Cost ` 97,800 Notes

,

58 000

Overhead Application Rate = × 100 = 59.3%

97 800

,

(c) Machine Hour Rate Method:

Estimated Factory Overheads ` 58,000

Estimated Machine Hours ` 50,500

58 000

,

Overhead Application Rate = = ` 1.149

50 500

,

(ii) Comparative Statement of Cost of Batch No. 488

direct Labour Rate direct Labour Cost Machine Hour Rate

Particulars

Method Method Method

Direct Materials 42 42 42

Consumed

Direct Labour 45 45 45

prime Cost 87 87 87

Factory Overhead 12.93 26.68 22.98

99.93 113.68 109.98

Example: The production department of a factory furnishes the following information

for the month of June, 2007.

Material ` 54,000

Director Wages ` 45,000

Labour-hours worked 36,000

Hours of machine operation 30,000

Overheads chargeable to the department ` 36,000

For an order executed by the department during the period, the relevant information was as under:

Material used ` 6,000

Direct wages ` 3,200

Labour hours worked 3,200

Hours of machine operation 2,400

Calculate the overhead charges chargeable to the job by the following methods: (a) Direct

materials cost percentage rate, (b) Labour hour rate, and (c) Machine hour rate.

Solution:

(a) Direct Material Cost percentage Rate:

Overhead exp enses

= × 100

Direct material cos t

,

36 000

= × 100 = 66.67%

54 000

,

LOVELY PROFESSIONAL UNIVERSITY 179