Page 202 - DCOM202_COST_ACCOUNTING_I

P. 202

Cost Accounting – I

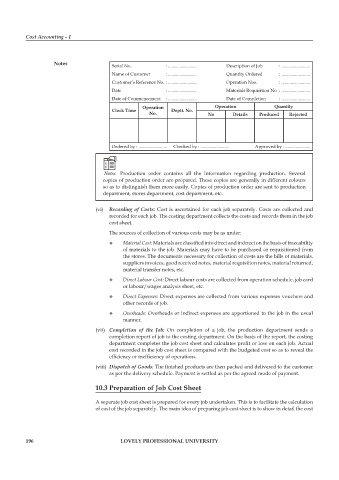

Notes Serial No. : ......................... Description of Job : .........................

Name of Customer : ......................... Quantity Ordered : .........................

Customer’s Reference No. : ......................... Operation Nos. : .........................

Date : ......................... Materials Requisition No. : .........................

Date of Commencement : ......................... Date of Completion : .........................

Operation Operation Quantity

Clock Time deptt. No.

No. No details Produced Rejected

Ordered by : ......................... Checked by : ......................... Approved by : ......................

Notes production order contains all the information regarding production. Several

copies of production order are prepared. These copies are generally in different colours

so as to distinguish them more easily. Copies of production order are sent to production

department, stores department, cost department, etc.

(vi) Recording of Costs: Cost is ascertained for each job separately. Costs are collected and

recorded for each job. The costing department collects the costs and records them in the job

cost sheet.

The sources of collection of various costs may be as under:

z Material Cost: Materials are classified into direct and indirect on the basis of traceability

of materials to the job. Materials may have to be purchased or requisitioned from

the stores. The documents necessary for collection of costs are the bills of materials,

suppliers invoices, good received notes, material requisition notes, material returned,

material transfer notes, etc.

z Direct Labour Cost: Direct labour costs are collected from operation schedule, job card

or labour/wages analysis sheet, etc.

z Direct Expenses: Direct expenses are collected from various expenses vouchers and

other records of job.

z Overheads: Overheads or indirect expenses are apportioned to the job in the usual

manner.

(vii) Completion of the Job: On completion of a job, the production department sends a

completion report of job to the costing department. On the basis of the report, the costing

department completes the job cost sheet and calculates profit or loss on each job. Actual

cost recorded in the job cost sheet is compared with the budgeted cost so as to reveal the

efficiency or inefficiency of operations.

(viii) Dispatch of Goods: The finished products are then packed and delivered to the customer

as per the delivery schedule. payment is settled as per the agreed mode of payment.

10.3 Preparation of Job Cost Sheet

A separate job cost sheet is prepared for every job undertaken. This is to facilitate the calculation

of cost of the job separately. The main idea of preparing job cost sheet is to show in detail the cost

196 LOVELY PROFESSIONAL UNIVERSITY