Page 204 - DCOM202_COST_ACCOUNTING_I

P. 204

Cost Accounting – I

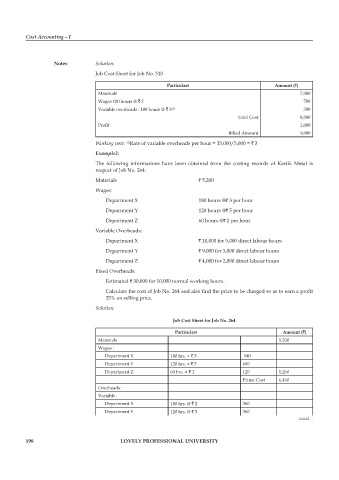

Notes Solution:

Job Cost Sheet for Job No. 510

Particulars Amount (`)

Materials 7,000

Wages 100 hours @ ` 7 700

Variable overheads : 100 hours @ ` 3 (1) 300

Total Cost 8,000

Profit 1,000

Billed Amount 9,000

Working note: Rate of variable overheads per hour = 15,000/5,000 = ` 3

(1)

Example2:

The following informations have been obtained from the costing records of Kartik Metal is

respect of Job No. 264:

Materials ` 5,200

Wages:

Department X 180 hours @` 3 per hour

Department Y 120 hours @` 5 per hour

Department Z 60 hours @` 2 per hour

Variable Overheads:

Department X ` 10,000 for 5,000 direct labour hours

Department Y ` 9,000 for 3,000 direct labour hours

Department Z ` 4,000 for 2,000 direct labour hours

Fixed Overheads:

Estimated ` 30,000 for 10,000 normal working hours.

Calculate the cost of Job No. 264 and also find the price to be charged so as to earn a profit

25% on selling price.

Solution:

Job Cost Sheet for Job No. 264

Particulars Amount (`)

Materials 5,200

Wages :

Department X 180 hrs. × ` 3 540

Department Y 120 hrs. × ` 5 600

Department Z 60 hrs. × ` 2 120 1,260

prime Cost 6,460

Overheads :

Variable :

Department X 180 hrs. @ ` 2 360

Department Y 120 hrs. @ ` 3 360

Contd…

198 LOVELY PROFESSIONAL UNIVERSITY