Page 205 - DCOM202_COST_ACCOUNTING_I

P. 205

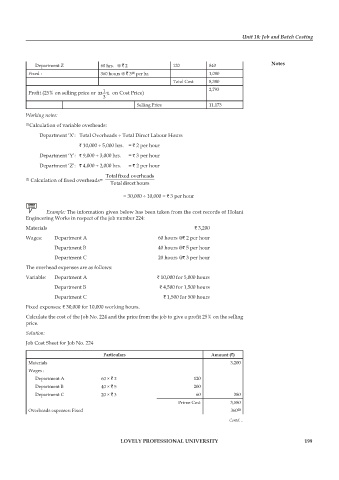

Unit 10: Job and Batch Costing

Department Z 60 hrs. @ ` 2 120 840 Notes

Fixed : 360 hours @ ` 3 per hr. 1,080

(2)

Total Cost 8,380

1

Profit (25% on selling price or 33 % on Cost price) 2,793

3

Selling price 11,173

Working notes:

(1) Calculation of variable overheads:

Department ‘X’: Total Overheads ÷ Total Direct Labour Hours

` 10,000 ÷ 5,000 hrs. = ` 2 per hour

Department ‘Y’: ` 9,000 ÷ 3,000 hrs. = ` 3 per hour

Department ‘Z’: ` 4,000 ÷ 2,000 hrs. = ` 2 per hour

Totalfixed overheads

(2) Calculation of fixed overheads =

Totaldirecthours

= 30,000 ÷ 10,000 = ` 3 per hour

Example: The information given below has been taken from the cost records of Holani

Engineering Works in respect of the job number 224:

Materials ` 3,200

Wages: Department A 60 hours @` 2 per hour

Department B 40 hours @` 5 per hour

Department C 20 hours @` 3 per hour

The overhead expenses are as follows:

Variable: Department A ` 10,000 for 5,000 hours

Department B ` 4,500 for 1,500 hours

Department C ` 1,500 for 500 hours

Fixed expenses: ` 30,000 for 10,000 working hours.

Calculate the cost of the Job No. 224 and the price from the job to give a profit 25% on the selling

price.

Solution:

Job Cost Sheet for Job No. 224

Particulars Amount (`)

Materials 3,200

Wages :

Department A 60 × ` 2 120

Department B 40 × ` 5 200

Department C 20 × ` 3 60 380

prime Cost 3,580

Overheads expenses: Fixed 360 (2)

Contd…

LOVELY PROFESSIONAL UNIVERSITY 199