Page 209 - DCOM202_COST_ACCOUNTING_I

P. 209

Unit 10: Job and Batch Costing

Notes

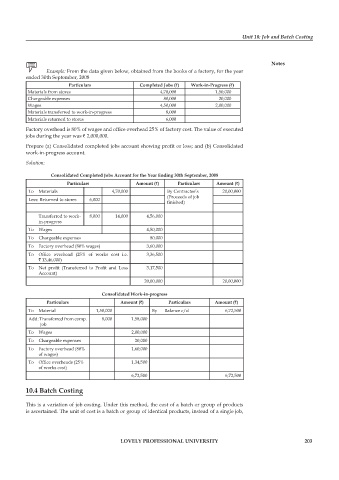

Example: From the data given below, obtained from the books of a factory, for the year

ended 30th September, 2008

Particulars Completed Jobs (`) Work-in-Progress (`)

Materials from stores 4,70,000 1,50,000

Chargeable expenses 80,000 20,000

Wages 4,50,000 2,00,000

Materials transferred to work-in-progress 8,000

Materials returned to stores 6,000

Factory overhead is 80% of wages and office overhead 25% of factory cost. The value of executed

jobs during the year was ` 2,000,000.

Prepare (a) Consolidated completed jobs account showing profit or loss; and (b) Consolidated

work-in-progress account.

Solution:

Consolidated Completed Jobs Account for the Year Ending 30th September, 2008

Particulars Amount (`) Particulars Amount (`)

To Materials 4,70,000 By Contractee’s 20,00,000

(proceeds of job

Less: Returned to stores 6,000 finished)

Transferred to work- 8,000 14,000 4,56,000

in-progress

To Wages 4,50,000

To Chargeable expenses 80,000

To Factory overhead (80% wages) 3,60,000

To Office overhead (25% of works cost i.e. 3,36,500

` 13,46,000)

To Net profit (Transferred to Profit and Loss 3,17,500

Account)

20,00,000 20,00,000

Consolidated Work-in-progress

Particulars Amount (`) Particulars Amount (`)

To Material 1,50,000 By Balance c/d 6,72,500

Add: Transferred from comp. 8,000 1,58,000

job

To Wages 2,00,000

To Chargeable expenses 20,000

To Factory overhead (80% 1,60,000

of wages)

To Office overheads (25% 1,34,500

of works cost)

6,72,500 6,72,500

10.4 Batch Costing

This is a variation of job costing. Under this method, the cost of a batch or group of products

is ascertained. The unit of cost is a batch or group of identical products, instead of a single job,

LOVELY PROFESSIONAL UNIVERSITY 203