Page 208 - DCOM202_COST_ACCOUNTING_I

P. 208

Cost Accounting – I

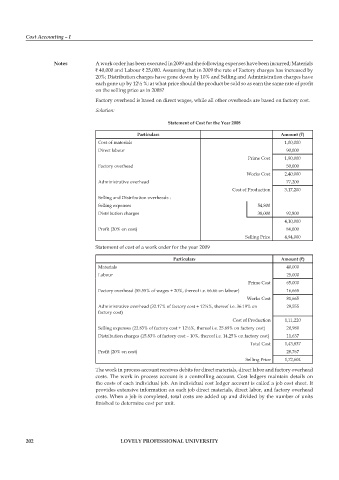

Notes A work order has been executed in 2009 and the following expenses have been incurred; Materials

` 40,000 and Labour ` 25,000. Assuming that in 2009 the rate of Factory charges has increased by

20%; Distribution charges have gone down by 10% and Selling and Administration charges have

each gone up by 12½ %; at what price should the product be sold so as earn the same rate of profit

on the selling price as in 2008?

Factory overhead is based on direct wages, while all other overheads are based on factory cost.

Solution:

Statement of Cost for the Year 2008

Particulars Amount (`)

Cost of materials 1,00,000

Direct labour 90,000

prime Cost 1,90,000

Factory overhead 50,000

Works Cost 2,40,000

Administrative overhead 77,200

Cost of production 3,17,200

Selling and Distribution overheads :

Selling expenses 54,800

Distribution charges 38,000 92,800

4,10,000

Profit (20% on cost) 84,000

Selling price 4,94,000

Statement of cost of a work order for the year 2009

Particulars Amount (`)

Materials 40,000

Labour 25,000

prime Cost 65,000

Factory overhead (55.55% of wages + 20%, thereof i.e. 66.66 on labour) 16,665

Works Cost 81,665

Administrative overhead (32.17% of factory cost + 12½%, thereof i.e. 36.19% on 29,555

factory cost)

Cost of production 1,11,220

Selling expenses (22.83% of factory cost + 12½%, thereof i.e. 25.69% on factory cost) 20,980

Distribution charges (15.83% of factory cost – 10%, thereof i.e. 14.25% on factory cost) 11,637

Total Cost 1,43,837

Profit (20% on cost) 28,767

Selling price 1,72,604

The work in process account receives debits for direct materials, direct labor and factory overhead

costs. The work in process account is a controlling account. Cost ledgers maintain details on

the costs of each individual job. An individual cost ledger account is called a job cost sheet. It

provides extensive information on each job direct materials, direct labor, and factory overhead

costs. When a job is completed, total costs are added up and divided by the number of units

finished to determine cost per unit.

202 LOVELY PROFESSIONAL UNIVERSITY