Page 267 - DCOM202_COST_ACCOUNTING_I

P. 267

Unit 13: Normal Wastage, Abnormal Loss and Abnormal Gain

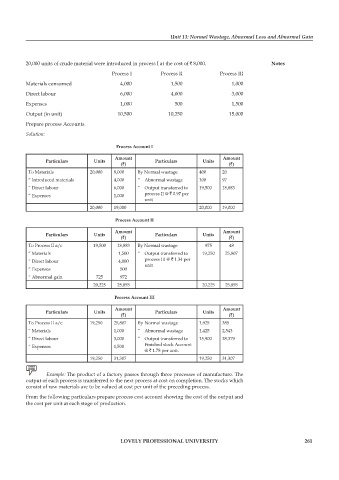

20,000 units of crude material were introduced in process I at the cost of ` 8,000. Notes

Process I Process II Process III

Materials consumed 4,000 1,500 1,000

Direct labour 6,000 4,000 3,000

Expenses 1,000 500 1,500

Output (in unit) 10,500 10,250 15,000

Prepare process Accounts.

Solution:

Process Account I

Amount Amount

Particulars Units Particulars Units

(`) (`)

To Materials 20,000 8,000 By Normal wastage 400 20

“ Introduced materials 4,000 “ Abnormal wastage 100 97

“ Direct labour 6,000 “ Output transferred to 19,500 18,883

“ Expenses 1,000 process II @ ` 0.97 per

unit

20,000 19,000 20,000 19,000

Process Account II

Amount Amount

Particulars Units Particulars Units

(`) (`)

To Process II a/c 19,500 18,883 By Normal wastage 975 48

“ Materials 1,500 “ Output transferred to 19,250 25,807

“ Direct labour 4,000 process III @ ` 1.34 per

unit.

“ Expenses 500

“ Abnormal gain 725 972

20,225 25,855 20,225 25,855

Process Account III

Amount Amount

Particulars Units Particulars Units

(`) (`)

To Process II a/c 19,250 25,807 By Normal wastage 1,925 385

“ Materials 1,000 “ Abnormal wastage 1,425 2,543

“ Direct labour 3,000 “ Output transferred to 15,900 28,379

“ Expenses 1,500 Finished stock Account

@ ` 1.78 per unit.

19,250 31,307 19,250 31,307

Example: The product of a factory passes through three processes of manufacture. The

output of each process is transferred to the next process at cost on completion. The stocks which

consist of raw materials are to be valued at cost per unit of the preceding process.

From the following particulars prepare process cost account showing the cost of the output and

the cost per unit at each stage of production.

LOVELY PROFESSIONAL UNIVERSITY 261