Page 268 - DCOM202_COST_ACCOUNTING_I

P. 268

Cost Accounting – I

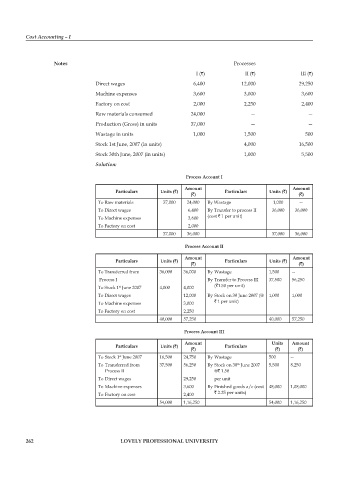

Notes processes

I (`) II (`) III (`)

Direct wages 6,400 12,000 29,250

Machine expenses 3,600 3,000 3,600

Factory on cost 2,000 2,250 2,400

Raw materials consumed 24,000 — —

production (Gross) in units 37,000 — —

Wastage in units 1,000 1,500 500

Stock 1st June, 2007 (in units) 4,000 16,500

Stock 30th June, 2007 (in units) 1,000 5,500

Solution:

Process Account I

Amount Amount

Particulars Units (`) Particulars Units (`)

(`) (`)

To Raw materials 37,000 24,000 By Wastage 1,000 --

To Direct wages 6,400 By Transfer to process II 36,000 36,000

To Machine expenses 3,600 (cost ` 1 per unit)

To Factory on cost 2,000

37,000 36,000 37,000 36,000

Process Account II

Amount Amount

Particulars Units (`) Particulars Units (`)

(`) (`)

To Transferred from 36,000 36,000 By Wastage 1,500 --

process I By Transfer to process III 37,500 56,250

st

To Stock 1 June 2007 4,000 4,000 (`1.50 per unit)

To Direct wages 12,000 By Stock on 30 June 2007 (@ 1,000 1,000

To Machine expenses 3,000 ` 1 per unit)

To Factory on cost 2,250

40,000 57,250 40,000 57,250

Process Account III

Amount Units Amount

Particulars Units (`) Particulars

(`) (`) (`)

To Stock 1 June 2007 16,500 24,750 By Wastage 500 --

st

To Transferred from 37,500 56,250 By Stock on 30 June 2007 5,500 8,250

th

process II @` 1.50

To Direct wages 29,250 per unit

To Machine expenses 3,600 By Finished goods a/c (cost 48,000 1,08,000

To Factory on cost 2,400 ` 2.25 per units)

54,000 1,16,250 54,000 1,16,250

262 LOVELY PROFESSIONAL UNIVERSITY