Page 272 - DCOM202_COST_ACCOUNTING_I

P. 272

Cost Accounting – I

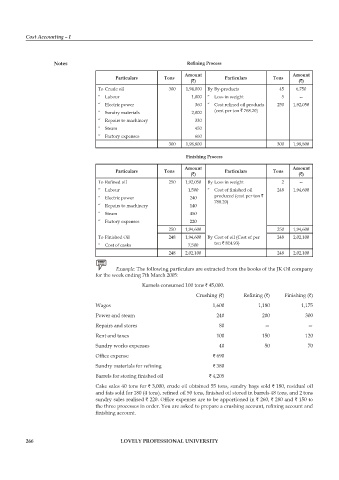

Notes Refining Process

Amount Amount

Particulars Tons Particulars Tons

(`) (`)

To Crude oil 300 1,94,000 By By-products 45 6,750

“ Labour 1,000 “ Loss in weight 5 --

“ Electric power 360 “ Cost refined oil products 250 1,92,050

“ Sundry materials 2,000 (cost per ton ` 768.20)

“ Repairs to machinery 330

“ Steam 450

“ Factory expenses 660

300 1,98,800 300 1,98,800

Finishing Process

Amount Amount

Particulars Tons Particulars Tons

(`) (`)

To Refined oil 250 1,92,050 By Loss in weight 2 --

“ Labour 1,500 “ Cost of finished oil 248 1,94,600

“ Electric power 240 produced (cost per ton `

788.20)

“ Repairs to machinery 140

“ Steam 450

“ Factory expenses 220

250 1,94,600 250 1,94,600

To Finished Oil 248 1,94,600 By Cost of oil (Cost of per 248 2,02,100

“ Cost of casks 7,500 ton ` 814.93)

248 2,02,100 248 2,02,100

Example: The following particulars are extracted from the books of the JK Oil company

for the week ending 7th March 2005:

Karnels consumed 100 tons ` 45,000.

Crushing (`) Refining (`) Finishing (`)

Wages 1,600 1,180 1,175

power and steam 240 200 300

Repairs and stores 80 — —

Rent and taxes 100 150 120

Sundry works expenses 40 50 70

Office expense ` 690

Sundry materials for refining ` 380

Barrels for storing finished oil ` 4,205

Cake sales 40 tons for ` 3,000, crude oil obtained 55 tons, sundry bags sold ` 180, residual oil

and fats sold for 180 (4 tons), refined oil 50 tons, finished oil stored in barrels 48 tons, and 2 tons

sundry sales realised ` 220. Office expenses are to be apportioned in ` 260, ` 280 and ` 150 to

the three processes in order. You are asked to prepare a crushing account, refining account and

finishing account.

266 LOVELY PROFESSIONAL UNIVERSITY