Page 274 - DCOM202_COST_ACCOUNTING_I

P. 274

Cost Accounting – I

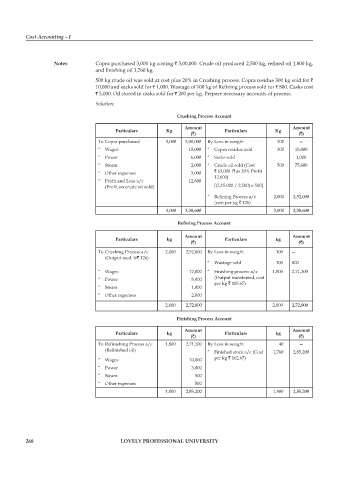

Notes Copra purchased 3,000 kg costing ` 3,00,000. Crude oil produced 2,500 kg, refined oil 1,800 kg,

and finishing oil 1,760 kg.

500 kg crude oil was sold at cost plus 20% in Crushing process. Copra residue 300 kg sold for `

10,000 and sacks sold for ` 1,000. Wastage of 100 kg of Refining process sold for ` 800. Casks cost

` 3,000. Oil stored in casks sold for ` 200 per kg. Prepare necessary accounts of process.

Solution:

Crushing Process Account

Amount Amount

Particulars Kg Particulars Kg

(`) (`)

To Copra purchased 3,000 3,00,000 By Loss in weight 200 —

“ Wages 15,000 “ Copra residue sold 300 10,000

“ Power 6,000 “ Sacks sold 1,000

“ Steam 2,000 “ Crude oil sold (Cost 500 75,600

“ Other expenses 3,000 ` 63,000 Plus 20% Profit

12,600)

“ Profit and Loss a/c 12,600

(Profit on crude oil sold) [(3,15,000 / 2,500) x 500]

“ Refining Process a/c 2,000 2,52,000

(cost per kg ` 126)

3,000 3,38,600 3,000 3,38,600

Refining Process Account

Amount Amount

Particulars kg Particulars kg

(`) (`)

To Crushing process a/c 2,000 2,52,000 By Loss in weight 100 --

(Output recd. @` 126)

“ Wastage sold 100 800

“ Wages 12,000 “ Finishing process a/c 1,800 2,71,200

“ Power 5,000 (Output transferred, cost

per kg ` 105.67)

“ Steam 1,000

“ Other expenses 2,000

2,000 2,72,000 2,000 2,72,000

Finishing Process Account

Amount Amount

Particulars kg Particulars kg

(`) (`)

To Refinishing Process a/c 1,800 2,71,200 By Loss in weight 40 —

(Refinished oil) “ Finished stock a/c (Cost 1,760 2,85,200

“ Wages 10,000 per kg ` 162.67)

“ Power 3,000

“ Steam 500

“ Other expenses 500

1,800 2,85,200 1,800 2,85,200

268 LOVELY PROFESSIONAL UNIVERSITY