Page 285 - DCOM202_COST_ACCOUNTING_I

P. 285

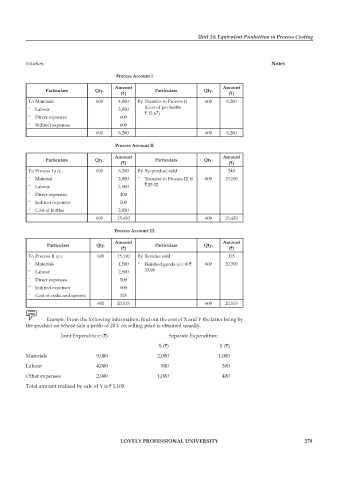

Unit 14: Equivalent Production in Process Costing

Solution: Notes

Process Account I

Amount Amount

Particulars Qty. Particulars Qty.

(`) (`)

To Materials 600 4,000 By Transfer to process II 600 8,200

“ Labour 3,000 (Cost of per bottle

` 13.67)

“ Direct expenses 600

“ Indirect expenses 600

600 8,200 600 8,200

Process Account II

Amount Amount

Particulars Qty. Particulars Qty.

(`) (`)

To process I a/c 600 8,200 By By-product sold 240

“ Material 2,000 “ Transfer to Process III @ 600 15,190

“ Labour 2,500 ` 25.32

“ Direct expenses 200

“ Indirect expenses 500

“ Cost of bottles 2,030

600 15,430 600 15,430

Process Account III

Amount Amount

Particulars Qty. Particulars Qty.

(`) (`)

To process II a/c 600 15,190 By Residue sold 125

“ Materials 1,500 “ Finished goods a/c @ ` 600 20,390

“ Labour 2,500 33.98

“ Direct expenses 500

“ Indirect expenses 500

“ Cost of casks and spoons 325

600 20,515 600 20,515

Example: From the following information, find out the cost of X and Y the latter being by

the product on whose sale a profit of 20% on selling price is obtained usually.

Joint Expenditure (`) Separate Expenditure

X (`) Y (`)

Materials 9,000 2,000 1,000

Labour 4,000 800 300

Other expenses 2,000 1,000 400

Total amount realised by sale of Y is ` 1,100.

LOVELY PROFESSIONAL UNIVERSITY 279