Page 289 - DCOM202_COST_ACCOUNTING_I

P. 289

Unit 14: Equivalent Production in Process Costing

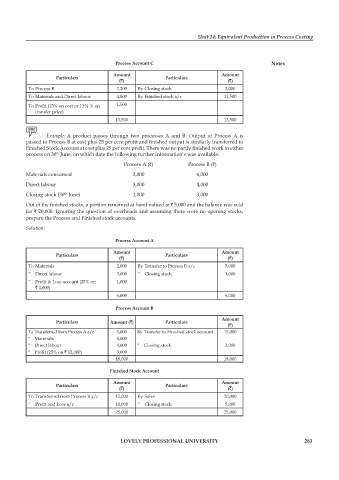

Process Account C Notes

Amount Amount

Particulars Particulars

(`) (`)

To process B 7,200 By Closing stock 2,000

To Materials and Direct labour 4,800 By Finished stock a/c 11,500

To Profit (15% on cost or 13 1 3 % on 1,500

transfer price)

13,500 13,500

Example: A product passes through two processes A and B. Output of process A is

passed to Process B at cost plus 25 per cent profit and finished output is similarly transferred to

Finished Stock Account at cost plus 25 per cent profit. There was no partly finished work in either

process on 30 June, on which date the following further information’s was available:

th

process A (`) process B (`)

Materials consumed 2,000 6,000

Direct labour 3,000 4,000

Closing stock (30 June) 1,000 3,000

th

Out of the finished stocks, a portion remained at hand valued at ` 5,000 and the balance was sold

for ` 20,000. Ignoring the question of overheads and assuming there were no opening stocks;

prepare the Process and Finished stock accounts.

Solution:

Process Account A

Amount Amount

Particulars Particulars

(`) (`)

To Materials 2,000 By Transfer to process B a/c 5,000

“ Direct labour 3,000 “ Closing stock 1,000

“ Profit & Loss account (25% on 1,000

` 4,000)

6,000 6,000

Process Account B

Amount

Particulars Amount (`) Particulars

(`)

To Transferred from process A a/c 5,000 By Transfer to Finished stock account 15,000

“ Materials 6,000

“ Direct labour 4,000 “ Closing stock 3,000

“ Profit (25% on ` 12,000) 3,000

18,000 18,000

Finished Stock Account

Amount Amount

Particulars Particulars

(`) (`)

To Transferred from process B a/c 15,000 By Sales 20,000

“ Profit and Loss a/c 10,000 “ Closing stock 5,000

25,000 25,000

LOVELY PROFESSIONAL UNIVERSITY 283