Page 293 - DCOM202_COST_ACCOUNTING_I

P. 293

Unit 14: Equivalent Production in Process Costing

Transferred from process 2 – 20,000 units @ ` 6 per unit. Transferred to process 4 – 17,000 units Notes

Expenditure incurred in process – 3

`

Direct Material 30,000

Direct Labour 60,000

Overheads 60,000

Scrap:1,000 units-Direct Materials 100%,Direct Labour 60%, Overheads 40%.

Normal Loss 10 % of production.

Scrapped units realized ` 4/- per unit

Closing stock : 4,000 units – Degree of completion. Direct Materials 80 %, Direct Labour 60 % and

Overheads 40 %.

prepare process 3 Account using average price method along with necessary supporting

statements.

Solution:

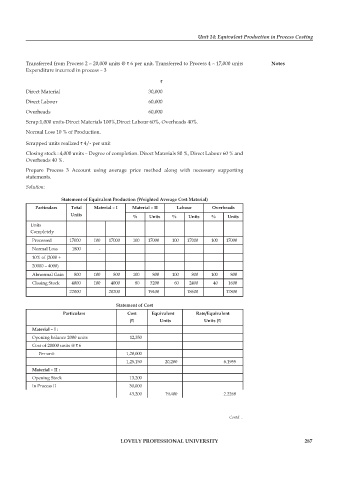

Statement of Equivalent Production (Weighted Average Cost Material)

Particulars Total Material – I Material – II Labour Overheads

Units % Units % Units % Units

Units

Completely

processed 17000 100 17000 100 17000 100 17000 100 17000

Normal Loss 1800 -

10% of (2000 +

20000 – 4000)

Abnormal Gain 800 100 800 100 800 100 800 100 800

Closing Stock 4000 100 4000 80 3200 60 2400 40 1600

22000 20200 19400 18600 17800

Statement of Cost

Particulars Cost Equivalent Rate/Equivalent

(`) Units Units (`)

Material – I :

Opening balance 2000 units 12,350

Cost of 20000 units @ ` 6

per unit 1,20,000

1,25,150 20,200 6.1955

Material – II :

Opening Stock 13,200

In process II 30,000

43,200 19,400 2.2268

Contd…

LOVELY PROFESSIONAL UNIVERSITY 287