Page 298 - DCOM202_COST_ACCOUNTING_I

P. 298

Cost Accounting – I

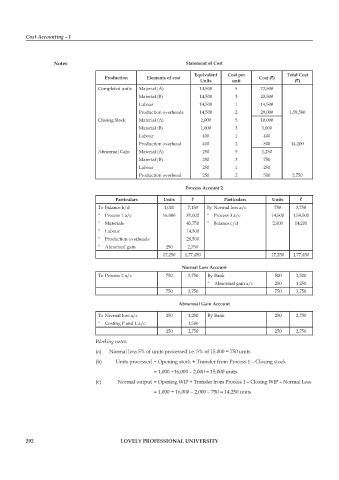

Notes Statement of Cost

Equivalent Cost per Total Cost

Production Elements of cost Cost (`)

Units unit (`)

Completed units Material (A) 14,500 5 72,500

Material (B) 14,500 3 43,500

Labour 14,500 1 14,500

production overheads 14,500 2 29,000 1,59,500

Closing Stock Material (A) 2,000 5 10,000

Material (B) 1,000 3 3,000

Labour 400 1 400

production overhead 400 2 800 14,200

Abnormal Gain Material (A) 250 5 1,250

Material (B) 250 3 750

Labour 250 1 250

production overhead 250 2 500 2,750

Process Account 2

Particulars Units ` Particulars Units `

To Balance b/d 1,000 7,150 By Normal loss a/c 750 3,750

“ Process 1 a/c 16,000 81,000 “ Process 3 a/c 14,500 1,59,500

“ Materials 43,750 “ Balance c/d 2,000 14,200

“ Labour 14,300

“ Production overheads 28,500

“ Abnormal gain 250 2,750

17,250 1,77,450 17,250 1,77,450

Normal Loss Account

To process 2 a/c 750 3,750 By Bank 500 2,500

“ Abnormal gain a/c 250 1,250

750 3,750 750 3,750

Abnormal Gain Account

To Normal loss a/c 250 1,250 By Bank 250 2,750

“ Costing P and L a/c 1,500

250 2,750 250 2,750

Working notes:

(a) Normal loss 5% of units processed i.e. 5% of 15,000 = 750 units

(b) Units processed = Opening stock + Transfer from Process 1 – Closing stock

= 1,000 +16,000 – 2,000 = 15,000 units

(c) Normal output = Opening WIp + Transfer from process 1 – Closing WIp – Normal Loss

= 1,000 + 16,000 – 2,000 – 750 = 14,250 units

292 LOVELY PROFESSIONAL UNIVERSITY