Page 297 - DCOM202_COST_ACCOUNTING_I

P. 297

Unit 14: Equivalent Production in Process Costing

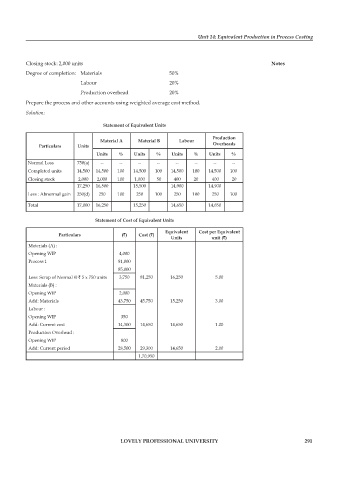

Closing stock: 2,000 units Notes

Degree of completion: Materials 50%

Labour 20%

production overhead 20%

prepare the process and other accounts using weighted average cost method.

Solution:

Statement of Equivalent Units

Production

Material A Material B Labour

Particulars Units Overheads

Units % Units % Units % Units %

Normal Loss 750(a) -- -- -- -- -- -- -- --

Completed units 14,500 14,500 100 14,500 100 14,500 100 14,500 100

Closing stock 2,000 2,000 100 1,000 50 400 20 400 20

17,250 16,500 15,500 14,900 14,900

Less : Abnormal gain 250(d) 250 100 250 100 250 100 250 100

Total 17,000 16,250 15,250 14,650 14,650

Statement of Cost of Equivalent Units

Equivalent Cost per Equivalent

Particulars (`) Cost (`)

Units unit (`)

Materials (A) :

Opening WIp 4,000

process 1 81,000

85,000

Less: Scrap of Normal @ ` 5 x 750 units 3,750 81,250 16,250 5.00

Materials (B) :

Opening WIp 2,000

Add: Materials 43,750 45,750 15,250 3.00

Labour :

Opening WIp 350

Add: Current cost 14,300 14,650 14,650 1.00

production Overhead :

Opening WIp 800

Add: Current period 28,500 29,300 14,650 2.00

1,70,950

LOVELY PROFESSIONAL UNIVERSITY 291