Page 296 - DCOM202_COST_ACCOUNTING_I

P. 296

Cost Accounting – I

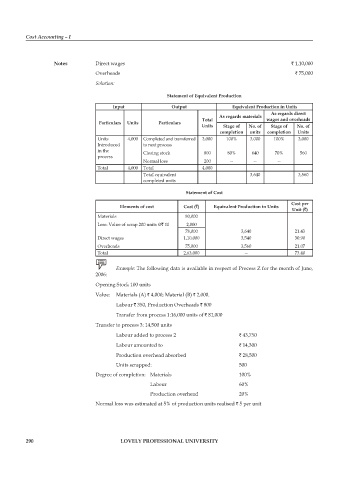

Notes Direct wages ` 1,10,000

Overheads ` 75,000

Solution:

Statement of Equivalent Production

Input Output Equivalent Production in Units

As regards direct

As regards materials

Total wages and overheads

Particulars Units Particulars

Units Stage of No. of Stage of No. of

completion units completion Units

Units 4,000 Completed and transferred 3,000 100% 3,000 100% 3,000

Introduced to next process

in the Closing stock 800 80% 640 70% 560

process

Normal loss 200 -- -- --

Total 4,000 Total 4,000

Total equivalent 3,640 3,560

completed units

Statement of Cost

Cost per

Elements of cost Cost (`) Equivalent Production in Units

Unit (`)

Materials 80,000

Less: Value of scrap 200 units @` 10 2,000

78,000 3,640 21.43

Direct wages 1,10,000 3,540 30.90

Overheads 75,000 3,560 21.07

Total 2,63,000 — 73.40

Example: The following data is available in respect of process Z for the month of June,

2006:

Opening Stock 100 units

Value: Materials (A) ` 4,000; Material (B) ` 2,000.

Labour ` 350, production Overheads ` 800

Transfer from process 1:16,000 units of ` 81,000

Transfer to process 3: 14,500 units

Labour added to process 2 ` 43,750

Labour amounted to ` 14,300

production overhead absorbed ` 28,500

Units scrapped: 500

Degree of completion: Materials 100%

Labour 60%

production overhead 20%

Normal loss was estimated at 5% of production units realised ` 5 per unit

290 LOVELY PROFESSIONAL UNIVERSITY