Page 294 - DCOM202_COST_ACCOUNTING_I

P. 294

Cost Accounting – I

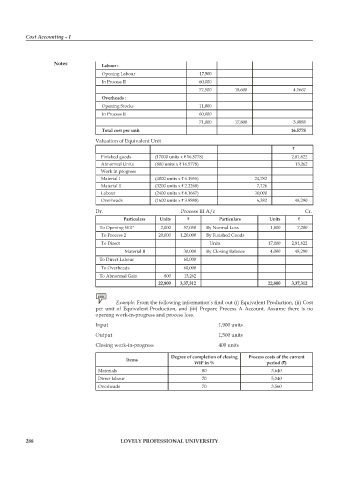

Notes Labour :

Opening Labour 17,500

In process II 60,000

77,500 18,600 4.1667

Overheads :

Opening Stocks 11,000

In process II 60,000

71,000 17,800 3.9888

Total cost per unit 16.5778

Valuation of Equivalent Unit

`

Finished goods (17000 units x ` 16.5778) 2,81,822

Abnormal Units (800 units x ` 16.5778) 13,262

Work in progress

Material I (4000 units x ` 6.1955) 24,782

Material II (3200 units x ` 2.2268) 7,126

Labour (2400 units x ` 4.1667) 10,000

Overheads (1600 units x ` 3.9888) 6,382 48,290

Dr. process III A/c Cr.

Particulars Units ` Particulars Units `

To Opening WIp 2,000 57,050 By Normal Loss 1,800 7,200

To process 2 20,000 1,20,000 By Finished Goods

To Direct Units 17,000 2,81,822

Material II 30,000 By Closing Balance 4,000 48,290

To Direct Labour 60,000

To Overheads 60,000

To Abnormal Gain 800 13,262

22,800 3,37,312 22,800 3,37,312

Example: From the following information’s find out (i) Equivalent Production, (ii) Cost

per unit of Equivalent production, and (iii) prepare process A Account. Assume there is no

opening work-in-progress and process loss.

Input 1,900 units

Output 1,500 units

Closing work-in-progress 400 units

degree of completion of closing Process costs of the current

Items

WIP in % period (`)

Materials 80 3,640

Direct labour 70 5,340

Overheads 70 3,560

288 LOVELY PROFESSIONAL UNIVERSITY