Page 287 - DCOM202_COST_ACCOUNTING_I

P. 287

Unit 14: Equivalent Production in Process Costing

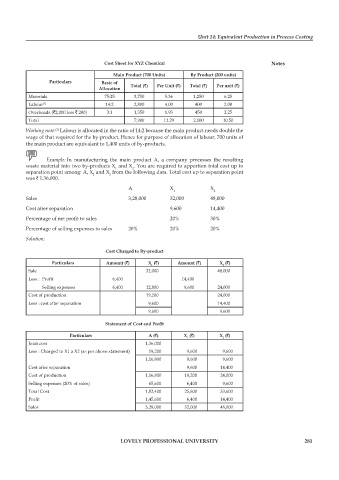

Cost Sheet for XYZ Chemical Notes

Main Product (700 Units) By Product (200 units)

Particulars Basic of

Allocation Total (`) Per Unit (`) Total (`) Per unit (`)

Materials 75:25 3,750 5.36 1,250 6.25

Labour (1) 14:2 2,800 4.00 400 2.00

Overheads (`2,000 less ` 200) 3:1 1,350 1.93 450 2.25

Total 7,900 11.29 2,100 10.50

Working note: Labour is allocated in the ratio of 14:2 because the main product needs double the

(1)

wage of that required for the by-product. Hence for purpose of allocation of labour, 700 units of

the main product are equivalent to 1,400 units of by-products.

Example: In manufacturing the main product A, a company processes the resulting

waste material into two by-products X and X . You are required to apportion total cost up to

2

1

separation point among: A, X and X from the following data. Total cost up to separation point

2

1

was ` 1,36,000.

A X X

1 2

Sales 3,28,000 32,000 48,000

Cost after separation 9,600 14,400

Percentage of net profit to sales 20% 30%

percentage of selling expenses to sales 20% 20% 20%

Solution:

Cost Charged to By-product

Particulars Amount (`) X (`) Amount (`) X (`)

2

1

Sale 32,000 48,000

Less : Profit 6,400 14,400

Selling expenses 6,400 12,800 9,600 24,000

Cost of production 19,200 24,000

Less : cost after separation 9,600 14,400

9,600 9,600

Statement of Cost and Profit

Particulars A (`) X (`) X (`)

1 2

Joint cost 1,36,000

Less : Charged to X1 a X2 (as per above statement) 19,200 9,600 9,600

1,16,800 9,600 9,600

Cost after separation 9,600 14,400

Cost of production 1,16,800 19,200 24,000

Selling expenses (20% of sales) 65,600 6,400 9,600

Total Cost 1,82,400 25,600 33,600

Profit 1,45,600 6,400 14,400

Sales 3,28,000 32,000 48,000

LOVELY PROFESSIONAL UNIVERSITY 281