Page 48 - DCOM202_COST_ACCOUNTING_I

P. 48

Cost Accounting – I

Notes

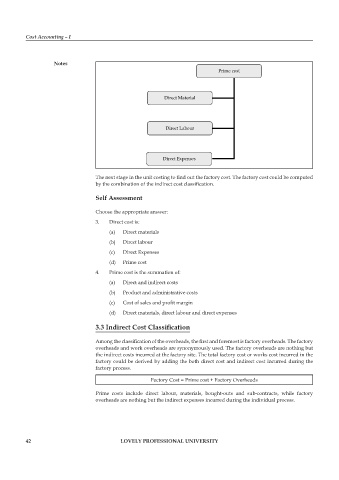

prime cost

Direct Material

Direct Labour

Direct Expenses

The next stage in the unit costing to find out the factory cost. The factory cost could be computed

by the combination of the indirect cost classification.

Self Assessment

Choose the appropriate answer:

3. Direct cost is:

(a) Direct materials

(b) Direct labour

(c) Direct Expenses

(d) prime cost

4. prime cost is the summation of:

(a) Direct and indirect costs

(b) product and administrative costs

(c) Cost of sales and profit margin

(d) Direct materials, direct labour and direct expenses

3.3 Indirect Cost Classification

Among the classification of the overheads, the first and foremost is factory overheads. The factory

overheads and work overheads are synonymously used. The factory overheads are nothing but

the indirect costs incurred at the factory site. The total factory cost or works cost incurred in the

factory could be derived by adding the both direct cost and indirect cost incurred during the

factory process.

Factory Cost = prime cost + Factory Overheads

prime costs include direct labour, materials, bought-outs and sub-contracts, while factory

overheads are nothing but the indirect expenses incurred during the individual process.

42 LOVELY PROFESSIONAL UNIVERSITY