Page 51 - DCOM202_COST_ACCOUNTING_I

P. 51

Unit 3: Cost Sheet and Unit Costing

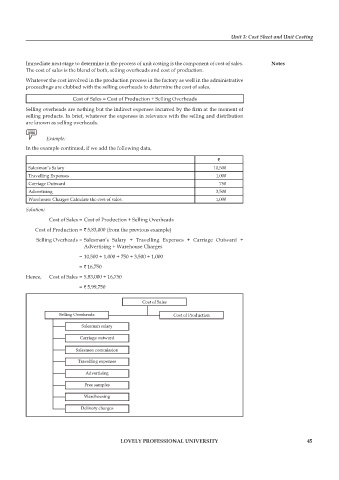

Immediate next stage to determine in the process of unit costing is the component of cost of sales. Notes

The cost of sales is the blend of both, selling overheads and cost of production.

Whatever the cost involved in the production process in the factory as well in the administrative

proceedings are clubbed with the selling overheads to determine the cost of sales.

Cost of Sales = Cost of production + Selling Overheads

Selling overheads are nothing but the indirect expenses incurred by the firm at the moment of

selling products. In brief, whatever the expenses in relevance with the selling and distribution

are known as selling overheads.

Example:

In the example continued, if we add the following data,

`

Salesman’s Salary 10,500

Travelling Expenses 1,000

Carriage Outward 750

Advertising 3,500

Warehouse Charges Calculate the cost of sales. 1,000

Solution:

Cost of Sales = Cost of production + Selling Overheads

Cost of production = ` 5,83,000 (from the previous example)

Selling Overheads = Salesman’s Salary + Travelling Expenses + Carriage Outward +

Advertising + Warehouse Charges

= 10,500 + 1,000 + 750 + 3,500 + 1,000

= ` 16,750

Hence, Cost of Sales = 5,83,000 + 16,750

= ` 5,99,750 Figure 2.7

Cost of Sales

Selling Overheads Cost of production

Salesman salary

Carriage outward

Salesmen commission

Travelling expenses

Advertising

Free samples

Warehousing

Delivery charges

LOVELY PROFESSIONAL UNIVERSITY 45